Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

The scalping strategy is the buying and selling of currency pairs in under a minute. That’s all there is to it.

But, it is not for everyone. Some traders develop their own scalping strategy in Forex and make a good income through the use of several tools and indicators.

In the following, we will discuss what you need to do to become a proficient scalper, and what is the best strategy for picking up these small gains on every trade.

“In trading/investing, it’s not about how much you make but rather how much you don’t lose.” - Bernard Baruch

As the name suggests, it is picking small gains by going in and out of the market extremely fast. It could be from 1 minute to 15 minutes.

This way of trading Forex is used by some traders as it helps them reap the gains from the smallest price fluctuations in the market several times a day. So, by the end of the day, the trader gets the accumulated profits gained over time.

Due to the dynamic nature of the Forex market, Forex scalping can be very useful for traders looking to develop short-term trading strategies.

It is fair to say that every trader can use such a strategy. It can be recommended for beginner traders because it uses small amounts of capital. Although scalping requires a lot of attention, it is still considered good for beginner traders who need some experience using different market instruments.

Many experienced traders also use the scalping strategy in Forex because they can better predict the market direction and therefore make higher gains.

Scalpers usually look to secure a 5-10 pips movement before they close their market position.

Forex scalping requires full attention and time, but once you know how to scalp Forex successfully it can get very profitable.

For example, if a trader is using a standard lot, where a 1-pip movement equals $10, then closing the market position after a 5-pip movement means securing a $50 profit or loss on a single trade.

Hence, if such a trade is repeated 10 times a day, that means that the trader has the potential of gaining $500, given that everything goes according to plan.

Scalping strategies are often compared to day trading strategies, since both see the trader opening and closing market positions on the same day, without rolling them over to the next day. Because of this, it can be easy for the day trader to also scalp in Forex.

Volatile markets, where prices move fiercely, are the best place for scalpers. Price movements in such market conditions are very fast, providing scalpers with a lot of opportunities. The volatile nature of the Forex market makes it a great place for scalpers.

One of the benefits of implementing a scalping trading strategy is that a trader does not need to worry about swap fees or any rollover fees the broker might charge. Such fees are mostly charged if positions remain open over night.

Now that you know what scalping in Forex is and how much you can expect to earn from it; before you start scalping, you should learn about the things you need to consider for scalping successfully. This includes the assets you trade and the broker you use.

Selecting the right market is the first step to having a winning Forex scalping strategy, and as we discussed earlier, volatile markets are the best place to start scalping. Forex markets especially provide enough volatility to make them easier for scalpers to profit on.

Selecting the right currency pairs is also crucial because a trader needs to select the currency pairs that are highly volatile and at the same time have a low spread range.

Even the best strategy for scalping Forex is done within a 5 or 10-minute window, or even 1-minute in some cases. Scalpers are looking for a currency pair that provides them with sufficient pip movement to secure some gains.

Therefore, volatile currency pairs such as EUR/USD or AUD/JPY are great options for scalpers, because these pairs fluctuate enough during the trading day to yield nice returns.

In addition, traders look for currency pairs that have small spread ranges, to make sure they don’t pay all of their profits in spreads.

To develop an easy scalping strategy, you need to find the currency pair that is volatile enough to remain profitable after deducting the spread that needs to be paid to the broker.

“Every trader has strengths and weaknesses. Some are good holders of winners but may hold their losers a little too long. Others may cut their winners a little short but are quick to take their losses. As long as you stick to your own style, you get the good and bad in your own approach.” - Michael Marcus

Besides selecting the right market and asset, selecting the right broker is also important because different brokers charge different spreads and a trader needs to look for a broker that offers the tightest spread ranges.

Before signing up with a broker, a trader needs to know that not every broker allows scalping. So, always check before you start trading with a certain broker.

Scalping is not a random activity, rather, there are Forex trading scalping strategies that a trader needs to implement after understanding the basics. This step-by-step goes as follows:

Forex scalping techniques can be beneficial if done the correct way, and the following steps are followed by most successful scalpers.

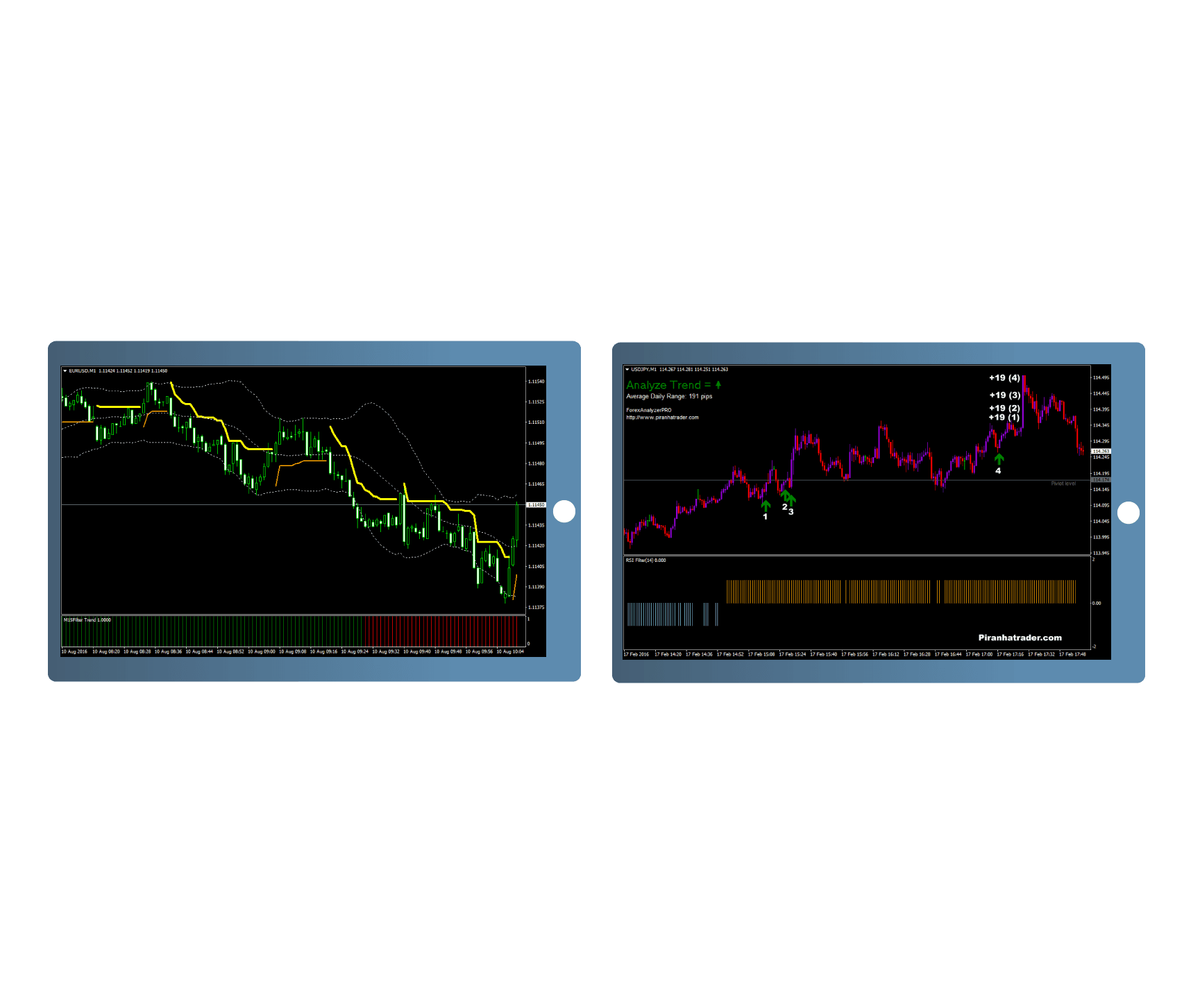

There are some indicators in the trading platforms that help scalpers develop the best scalping strategy because they are designed to technically analyze the short-term price movement of a certain asset. See our guides on the best indicators for MT4 and best indicators for MT5 for more info.

Bollinger Bands are useful for scalpers to have an idea about the movement of the asset and its volatility.

This indicator helps the trader’s scalping strategy because it is represented by lines above and below the average price line. These lines contract and expand according to the market's volatility. This gives the trader a great idea about how volatile the market is, indicating whether it is a good time to scalp.

If the price goes near the lower band, it indicates a buying opportunity because the price is going low, and if the price is close to the upper band it represents a selling opportunity.

Another signal that is very useful for the scalping method in Forex trading is the moving averages because this signal depicts the projected price movement based on historical price fluctuations.

Using the moving average indicator could be a simple scalping strategy that gives the traders a view of the predicted direction of the price.

It is common for traders to set stop-loss and take-profit limits on their trades, which is not recommended in this case, because there is basically no time to set these limits, as every second counts when scalping in Forex.

Scalping is a very short-term strategy where traders open and close market positions within minutes, it can be anywhere from 1 to 15 minutes.

It is uncommon for scalpers to keep their market position for more than 15 minutes, but it can happen based on different market conditions, or when the market does not move quickly enough.

There is really no best timeframe for a scalping strategy, but 1 minute and 5 minutes are the most used timeframe by scalpers.

Since scalping relies on volatility, a trader needs to select the best time to enter the market, making sure that it is volatile enough to realize gains over a few minutes.

A scalper looks at the times when the international financial markets are active, and generally start trading when several markets around the world are open at the same time.

8:00-10:00 AM EST could be the best time to implement your Forex scalping strategy, as at this time several markets are open all at once, and there are many news releases and options that expire, which causes the markets to fluctuate.

Good trading platforms for scalpers are those that offer all the indicators and charts a scalper needs.

MT4, MT5, and cTrader are some of the most used platforms in this regard since they incorporate all the indicators a scalper needs, such as Bollinger Bands, Elliot Wave, moving averages, and stochastic oscillators.

As good as scalping in Forex might sound, there are a few reasons why some traders do not use this strategy. We will now take a look at the advantages and disadvantages of scalping.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Yes, basically any trader can scalp Forex, however, professional traders have better analytical and prediction skills which makes them better at scalping.

Usually, scalpers try to get 5-10 pips of movement before closing the market position. And if a trader is using a standard lot where 1 pip = $10, a 5-pips movement = $50 for a single trade.

Now, given the fact that scalpers repeat this activity a few times a day, it means that whatever can be gained in one trade, is multiplied by how many times they repeat that on the same day.

1 to 15 minutes is considered a good timeframe. There is no such thing as a “best” timeframe, but most scalpers use a 1-5 minute timeframe.

A 15 minutes timeframe is uncommon among scalpers, but it can be used when the asset is not volatile enough and a scalper is waiting for pip movement.

It depends on many factors. First of all, the time that you can dedicate to watching your trade because scalping means that you have to give your full attention to the trade from opening until you close it.

Secondly, it depends on your preference. If you prefer short-term gains, then scalping can be good, but if you look to have long-term gains, then scalping is not for you, because it is basically a 15-minute trade activity.

Finally, it depends on whether you are a risk-taker or risk-averse. Because scalping is identified as less risky than other trading strategies, it is considered a safer strategy for less risk-tolerant individuals.

GBP/USD and AUD/USD are the most used currencies for scalping because they are very volatile. EUR/USD is also very common among scalpers and many develop their own EUR/USD scalping strategy due to the pair’s popularity and its association with global news and events.