Forex trading is legal and well-regulated in the Netherlands. The country is a member of the EU and also has its regulator, Autoriteit Financiële Markten' (AFM), or the Dutch Authority for the Financial Markets. The AFM has been around since 2002 and all the Forex brokers that have branches in the country should get licenses from it.

Since the Netherlands is a member of the EU, brokers who are regulated by the ESMA or European Securities and Markets Authority or adhere to the regulations and standards of MiFID II can also offer financial services to residents.

There is no capital gains tax on crypto trading in the Netherlands, but all other forms of trading are taxed as the income from wealth calculated as total assets minus debts. This is why it may be more useful to opt for crypto trading when in the Netherlands. The tax rate on taxable income (including trading profits) are astonishing 30% which is super high compared to many other countries.

Quick overview of the best Forex brokers in the Netherlands

In the list below, we have gathered the top five Forex brokers in the Netherlands.

XM

Read the review

Visit broker 8.4 8.34 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.03% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Tickmill

Read the review

Visit broker 7.6 6.29 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd. You should consider whether you understand how CFDs or our other products work and whether you can afford to take the high risk of losing your money.

|

AvaTrade

Read the review

Visit broker 8.8 7.63 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Pepperstone

Read the review

Visit broker 8.2 7.75 Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

|

Saxo Bank

Read the review

Visit broker 8.32 6.85 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Losses can exceed deposits on some products.

| |

| Offers accounts in the Netherlands under | CySEC, Cyprus | CySEC, Cyprus | CBI, Ireland | CySEC, Cyprus | AFM, Netherlands |

| Account entity for the Netherlands | Trading Point of Financial Instruments Limited | Tickmill Europe Ltd | AVA Trade EU Ltd | Pepperstone EU Limited | Saxo Bank A/S |

| Offers Netherlands stocks | Yes | Yes | Yes | Yes | Yes |

| Spreads on EURUSD | From 1 pip | From 1.6 pips | From 0.9 pips | From 1 pip | From 0.9 pips |

| Spreads on Crude Oil | from 0.02 | - | 0.03% over market | From 2.5 | From 0.05 USD |

| Spreads on Brent Oil | from 0.02 | From 0.04 | 0.01% over market | From 2.5 | 3 USD per contract |

| Spreads on Gold | From 2.6 pips | From 0.09 USD | 0.29 USD over market | From 0.5 USD | From 0.13 USD |

| Spreads on BTC/USD | From 46.00 | - | - | From 17 pips | From 108 USD |

| Maximum Leverage | 1:30 for Netherlands | 1:30 for Netherlands | 1:30 for Netherlands | 1:30 for Netherlands | 1:30 for Netherlands |

| Minimum Deposit | 5 EUR | 100 EUR | 100 EUR | 0 EUR | 0 EUR |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade | MetaTrader 4 and 5, cTrader | SaxoTraderGO, SaxoTraderPro |

XM

XM is a popular and reliable Forex and CFDs broker that is regulated in several jurisdictions including the Cyprus CySEC. The entity of the XM operating within the EU is Trading Point of Financial Instruments Limited under the CySEC license. The broker accepts clients from the Netherlands and offers very competitive conditions with a wide selection of assets including stocks and low spreads on various instruments.

The exact list of tradable instruments provided by the XM is listed below:

- 50 Forex pairs

- 58 Cryptocurrencies

- 1000+ stock CFDs

- 7 turbo stocks

- 8 commodities

- 20 indices

- 3 precious metals

- 3 energies

- 26 stocks from the Netherlands

XM offers several trading accounts to appeal to different trading styles and budgets. The minimum deposit for the EU and Netherlands is the same from 5 EUR and spreads are also very competitive. EUR/USD comes with 0.6 pips on Ultra Low account and Gold has from 0.26 USD or 2.6 pips. The broker offers a multitude of EU stocks on popular European companies. XM offers turbo stocks and stock CFDs including stocks from the Netherlands for 26 different companies.

Visit broker

8.4

8.34

| Micro | Standard | XM Ultra Low | |

|---|---|---|---|

| Spreads on EURUSD | From 1 pip | From 1 pip | From 0.6 pips |

| Spreads on Crude Oil | from 0.02 | from 0.02 | from 0.02 |

| Spreads on Brent Oil | from 0.02 | from 0.02 | from 0.02 |

| Spreads on Gold | From 2.6 pips | From 2.6 pips | From 1.5 pips |

| Spreads on BTC/USD | From 46.00 | From 46.00 | From 35.00 |

| Minimum Deposit | 5 USD, EUR, GBP | 5 USD, EUR, GBP | 5 USD, EUR, GBP |

| Minimum lot size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum leverage | 1:30 for retail (1:1000 for pros) | 1:30 for retail (1:1000 for pros) | 1:30 for retail (1:1000 for pros) |

| Negative Balance Protection | Yes | Yes | Yes |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

Tickmill

Tickmill is a reliable and regulated broker available in the Netherlands. The entity in Europe including the Netherlands is Tickmill Europe Ltd, which is regulated by the Cyprus Securities and Exchange Commission (CySEC). Now, the maximum allowed leverage by CySEC for retail Forex traders is limited to 1:30 which is also the case for the FX traders in the Netherlands.

Tickmill offers access to diverse markets for Qatar residents including

- 62 Forex pairs

- 15 indices

- 7 commodities

- 500 stock and ETFs

- 15+ futures and options

Tickmill offers stocks for trading appealing to traders from the Netherlands as they can select both stocks or FX pairs to speculate.

Visit broker

7.6

6.29

| Pro | Classic | VIP | |

|---|---|---|---|

| Spreads on EURUSD | From 0.0 pips | From 1.6 pips | From 0.0 pips |

| Commissions | 2 USD per side per lot | none | 1 USD per side per lot |

| Spreads on Crude Oil | - | - | - |

| Spreads on Brent Oil | From 0.04 | From 0.04 | From 0.04 |

| Spreads on Gold | From 0.09 USD | From 0.09 USD | From 0.09 USD |

| Spreads on BTC/USD | - | - | - |

| Minimum Deposit | 100 USD/EUR/GBP | 100 USD/EUR/GBP | - |

| Maximum Leverage | 1:30 for retails, 1:500 for professionals | 1:30 for retails, 1:500 for professionals | 1:30 for retails, 1:500 for professionals |

| Negative Balance Protection | Yes | Yes | - |

| Minimum Lot Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

AvaTrade

AvaTrade is a reputable and very well-regulated Forex and CFDs broker that is available in the Netherlands. AVA Trade EU Ltd is the name of a legal entity that is accepting clients from the EU and Netherlands, it is regulated by the Central Bank of Ireland.

Here is the exact list of types and numbers of AvaTrade trading instruments for FX traders in the Netherlands:

- 64 Forex pairs

- 20 cryptos

- 30 indices

- 17 commodities

- 633+ stocks

The leverage for stock trading is 1:10 and spreads are + 0.13% on the market prices. All the spreads are very competitive and trading platforms are numerous. For trading stocks, Forex, and cryptos, AvaTrade seems overall one of the top brokers that are strictly regulated in the EU.

Visit broker

8.8

7.63

| Retail | Professional | |

|---|---|---|

| Spreads on EURUSD | From 0.9 pips | From 0.3 pips |

| Commissions | 0 USD | 0 USD |

| Spreads on Crude Oil | 0.03% over market | 0.03% over market |

| Spreads on Brent Oil | 0.01% over market | 0.01% over market |

| Spreads on Gold | 0.29 USD over market | 0.29 USD over market |

| Spreads on BTC/USD | 0.15% Over-market | 0.15% Over-market |

| Minimum Deposit | 100 EUR | 100 EUR |

| Maximum Leverage | 1:30 for retails, 1:400 for pros | 1:400 |

| Negative Balance Protection | Yes | Yes |

| Minimum Lot Size | From 0.01 lots | From 0.01 lots |

| Trading Platforms | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

Pepperstone

Pepperstone is available in the Netherlands and the legal entity accepting clients from the EU is Pepperstone EU Limited which is regulated by the CySEC (Cyprus Securities and Exchange Commission). Among the multitude of trading instruments, there are 1000+ stocks added recently, offering pro traders the ability to speculate on numerous markets at once.

Trading instruments offered by Pepperstone in a wide range of asset classes include

- 62 currency pairs

- 1,000+ share CFDs

- 23 crypto CFDs

- 32 commodities

- 23 indices

As per EU and Netherlands regulations, Pepperstone only offers up to 1:30 leverage to local retail traders, meanwhile, pros can get up to 1:400 leverage. Pepperstone offers AU, US, UK, and German shares for trading. The commission varies from 0.07% to 0.1% depending on the stock exchange.

Visit broker

8.2

7.75

| Razor account | Standard account | |

|---|---|---|

| Spreads on EUR/USD | From 0 pips | From 1 pip |

| Spreads on Crude Oil | From 2.5 | From 2.5 |

| Spreads on Brent Oil | From 2.5 | From 2.5 |

| Spreads on Gold | From 0.5 USD | From 0.5 USD |

| Spreads on BTC/USD | From 17 pips | From 17 pips |

| Commissions | USD 3.50 (USD 7 round turn or equivalent in EUR) | No |

| Minimum Deposit | 0 EUR | 0 EUR |

| Minimum lot size | From 0.01 lots | From 0.01 lots |

| Negative Balance Protection | Yes | Yes |

| Maximum Leverage | 1:30 (1:400 for pro traders) | 1:30 (1:400 for pro traders) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, MetaTrader 5, cTrader |

Saxo

Saxo is directly regulated by the Netherlands Authority for the Financial Markets (AFM) which makes it among the top broker's list for FX traders in the Netherlands. The bank and broker Saxo offers a multitude of trading asset classes for trading including

- 185+ Forex pairs

- 140+ forwards

- 8,800+ CFDs

- 45+ FX vanilla options

- 23,500 stocks

- 7,000 ETFs on 30+ exchanges

- 300+ futures

- Bonds from 26 countries and 21 currencies

- 3,200+ listed options

- 250 top-rated mutual funds

- 6 FX crypto pairs

Saxo’s list of instruments is truly staggering as it offers thousands of instruments in around 10 different asset classes. Stocks include companies from the Netherlands which can be very attractive for local FX and stock traders.

Visit broker

8.32

6.85

| Classic | Platinum | VIP | |

|---|---|---|---|

| Spreads on EURUSD | From 0.9 pips | From 0.8 pips | From 0.7 pips |

| Commissions | 0 | 0 | 0 |

| Spreads on Crude Oil | From 0.05 USD | From 0.05 USD | From 0.03 USD |

| Spreads on Brent Oil | 3 USD per contract | 2 USD per contract | 1 USD per contract |

| Spreads on Gold | From 0.13 USD | From 0.12 USD | From 0.10 USD |

| Spreads on BTC/USD | From 108 USD | From 93 USD | From 71 USD |

| Minimum Deposit | 0 USD | 200,000 USD | 1,000,000 USD |

| Maximum Leverage | 1:30 | 1:1 | 1:1 |

| Negative Balance Protection | Yes | No | No |

| Minimum Lot Size | 0.01 lots | 0.1 lots | 1 lot |

| Trading Platforms | SaxoTraderGO, SaxoTraderPro | SaxoTraderGO, SaxoTraderPro | SaxoTraderGO, SaxoTraderPro |

Best choice of the broker in the Netherlands by category

We have selected several asset types that can be popular among Forex traders from the Netherlands and will present the best brokers in each category.

Best Broker in the Netherlands for Forex Trading

| XM | Tickmill | AvaTrade | Pepperstone | Saxo | |

|---|---|---|---|---|---|

| Number of Forex pairs | 50 | 62 | 64 | 62 | 185+ |

| Typical spreads on EUR/USD | From 1 pip | From 1.6 pips | From 0.9 pips | From 1 pip | From 0.9 pips |

It is a close call between Saxo and AvaTrade when it comes to low spreads in FX trading for the Netherlands. Saxo has more FX pairs while the spreads are equal to 0.9 pips for both brokers.

Best Broker in the Netherlands for Stock Trading

| XM | Tickmill | AvaTrade | Pepperstone | Saxo | |

|---|---|---|---|---|---|

| Number of stocks | 1000+ | 500 | 633+ | 1,000+ | 23,500 |

The largest number of stocks is offered by Saxo for stock traders and it also offers a multitude of exchanges worldwide. It has to be noticed that all brokers in the list offer stocks on the companies operating in the Netherlands.

Best Broker in the Netherlands for commodities Trading

| XM | Tickmill | AvaTrade | Pepperstone | Saxo | |

|---|---|---|---|---|---|

| Number of commodities | 14 | 7 | 17 | 32 | - |

| Typical spreads on Crude Oil | from 0.02 | - | 0.03% over market | From 2.5 | From 0.05 USD |

| Typical spreads on Brent Oil | from 0.02 | From 0.04 | 0.01% over market | From 2.5 | 3 USD per contract |

| Typical spreads on Gold | From 2.6 pips | From 0.09 USD | 0.29 USD over market | From 0.5 USD | From 0.13 USD |

For commodities, XM and Pepeprstone offer the best conditions with low spreads and a multitude of commodities to speculate on.

How do you check if the AFM of the Netherlands regulates the broker?

The brokers in our list are all regulated in the EU and are allowed to offer services to the FX traders in the Netherlands. So, reading our list of brokers is the easiest way to find suitable brokers when trading from the Netherlands. To research and check whether the broker is truly regulated in the Netherlands there are several steps to follow.

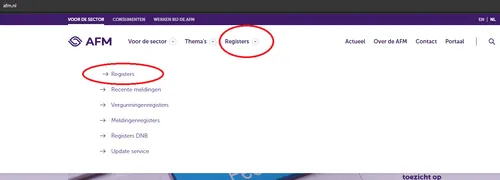

Step One: Visit the website of the regulator

The first step is to visit the AFM website (www.afm.nl) and place the cursor on the Registers section and in the menu select Registers.

Step Two: Navigate to the register database

You will be navigated to the section where it is possible to search regulated entities in the AFM database. Write the name of the broker and click on the search icon.

Step Three: Search for the brokers regulated by the AFM in the database

After filling in the search field and clicking on the search icon the page will load all the related articles and regulated entities with the name you have entered.

All AFM-regulated Forex Broker Reviews

Below are all the brokers with full unbiased reviews that are regulated by the AFM in the Netherlands. Ensure to read full reviews before signing up for any of the Forex brokers.