The Exness Group (Exness for short) was founded in 2008. Headquartered in Limassol, Cyprus; Exness provides access to trading Forex pairs, stocks as CFDs, indices, commodities, and cryptocurrencies as CFDs. On the downside, the Exness Group does not accept clients from several jurisdictions, including the USA.

Exness is authorized and regulated by various financial institutions. The list includes:

The Financial Services Authority in Seychelles (FSA), the Central Bank of Curaçao and Sint Maarten (CBCS), the Financial Services Commission in BVI (FSC), the Financial Services Commission (FSC) in Mauritius, the Financial Sector Conduct Authority (FSCA) in South Africa, the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the United Kingdom.

The long list of well-established regulatory bodies makes the broker more trustworthy in the eyes of its clients.

Exness offers various account types to meet the needs of various types of traders. In addition, traders can choose from a wide range of base currencies when opening trading accounts to save on conversion costs. Exness offers unlimited leverage for trading certain types of products.

The fees vary depending on the account type you choose and the asset class you trade. We’ll discuss the fees, regulations, instruments, platforms, and in more detail in today’s review.

Here Are the 10 Pros and Cons:

- Regulated in 7 jurisdictions

- Offers access to MetaTrader 4, MetaTrader 5, and Exness Terminal

- Charges no deposit and withdrawal fees

- Offers 5 account types

- A huge number of account base currencies to choose from

- Fast and digital account opening/verification

- A low minimum deposit is required to open an account. Namely 10 USD.

- No inactivity fee

- Offers instant withdrawals

- The number of stock CFDs is limited to 100

Exness Fact sheet

| Main features | |

| Regulations | BVI, Curaçao, Cyprus, Kenya, Mauritius, Seychelles, UKBVI, Curaçao, Cyprus, Kenya, Mauritius, Seychelles, UK |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 10 USD. 200 USD for Pro account types. 50 USD when depositing using Perfect Money. 10,000 USD when using Bank Wire Transfer |

| Minimum deposit | 10 USD |

| Minimum account activation | 0 USD |

| Number of available assets | 256 |

| Leverage up to | 1:Unlimited |

| Available trading markets | Forex, CFDs on stocks, Indices, Commodities, Cryptocurrencies |

| Account currencies | AED ARS AUD AZN BDT BHD BND BRL CAD CHF CNY EGP EUR GBP GHS HKD HUF IDR INR JOD JPY KES KRW KWD KZT MAD MXN MYR NGN NZD OMR PHP PKR QAR SAR SGD THB UAH UGX USD UZS VND XOF ZAR. USC EUC GBC CHC AUC CAC for Standard Cent account |

| Demo account | Yes |

| Live account types | Standard, Standard Cent, Raw Spread, Zero, Pro |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 98 |

| Shares | 0 |

| Cryptocurrencies | 35 |

| Indices | 10 |

| Commodities | 13 |

| Total | 256 |

| Fees & spread | |

| Forex | From 0.3 pips 1 avg, spread on EUR/USD Standard account |

| Shares | Variable, depending on the stock. The commissions change according to underlying exchange rates. |

| Cryptocurrencies | From 4.2 |

| Indices | From 3 |

| Commodities | From 2 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, Exness Terminal |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

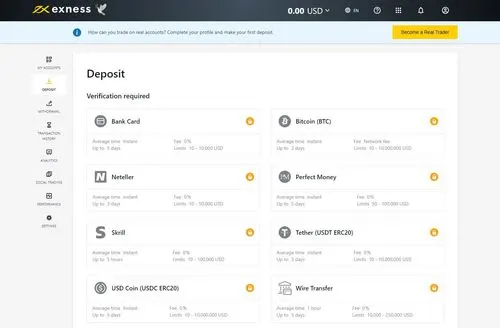

| Payment methods | Credit/Debit Card, Bank Wire transfer, Skrill, Netteler, Perfect Money, Bitcoin, USD Coin, Tether |

| Minimum deposit | Credit/Debit Card, Bank Wire transfer, Skrill, Netteler, Perfect Money, Bitcoin, USD Coin, Tether. Payments are processed even on Weekends |

| Minimum withdrawal | Credit/Debit Card, Bank Wire transfer, Skrill, Netteler, Perfect Money, Bitcoin, USD Coin, Tether. Bank Wire transfer option is not available |

| Withdrawal processing time | Instant. Crypto and Bank wire deposits and withdrawals take up to 72 hours |

| Time to open an account | - |