Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Pips or percentages in points are the standard way of measuring the price movement in Forex. It helps traders define profits and losses and helps them see price movements more intuitively. In a world of financial trading, such as Forex, pips play a crucial role in defining a trader’s risks and rewards as well. Planning effectively and turning a profit can be extremely challenging, if not impossible, without a solid understanding of what pips are and how they function. Let’s explain pips in more detail below.

Pips are essential for traders to gauge profits and losses. As most of the currencies are quoted in four decimal places such as EURUSD, GBPUSD, AUDUSD, etc. the pips are the change in their fourth decimal place. An exception is Japanese yen pairs, which are quoted in two decimal places. Let’s take an example from currency pairs to understand pips even better.

When the EURUSD moves from 1.1010 to 1.1011 we say that it moved by 1 pip (1.1011 – 1.1010 = 1).

When USDJPY moves from 140.10 to 140.11 we say that USDJPY has moved 1 pip (140.11 – 140.10 = 1). Now, we have settled on how to measure price movements more intuitively, but how much does 1 pip cost?

The standard contract size in Forex is 1 lot and is equal to 100,000 currency units. In the case of trading with 100,000 or 1 standard lot, each 1 pip change in price is equal to 0.0001 times 100,000 or 10 USD. However, many traders, especially beginners, trade with much lower volumes of 0.1 or even 0.01 lots sometimes. For 0.1 lots, 1 pip is equal to 1 USD, and 0.1 USD for 0.01 lots. This is the most intuitive way to calculate potential losses and profits. Although these measurements are simplified and the majority of times 1 pip may be more or less than 10 USD, it is the most intuitive way to understand pips and measure the price movements in FX.

Here is the list of lot sizes and 1 pip costs in USD:

So, if you opened a EURUSD trade with 1 lot, every pip movement would equal to win or loss of 10 USD. Knowing this, it is simpler to define your risks and avoid losing too much too quickly.

But why do pips matter? Since it is the industrial standard for calculating price movements, every trader needs to memorize pips' meaning. Pips gives traders the ability to simplify the process of describing strategies and calculating profits and losses.

Every Forex broker displays spreads in pips on their website. Spreads are an essential part of trading costs, and knowing pips helps traders define if the offered spreads are cheap or expensive.

Using pips, traders do not have to calculate price movements in decimal numbers but rather in pips. It is much more appealing to understand price movements in pips rather than in decimals like 0.0001.

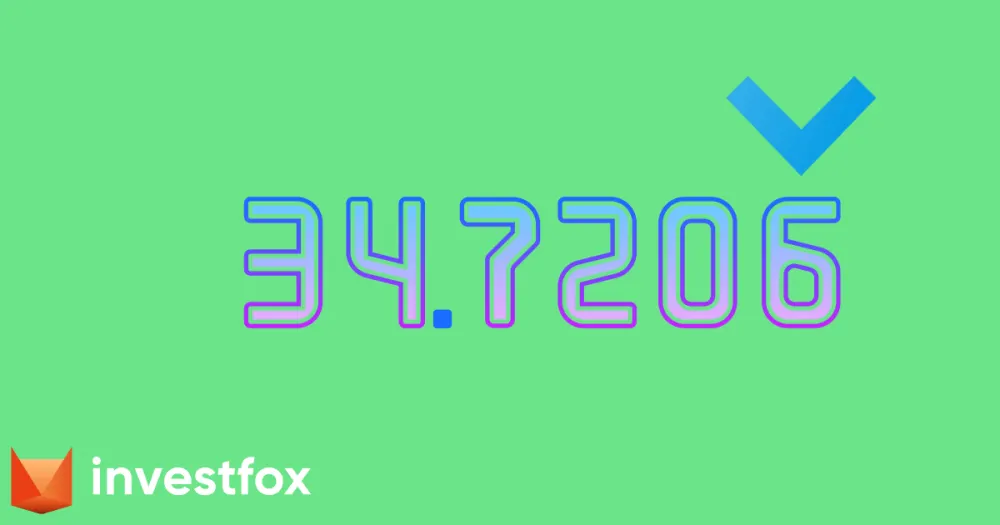

Pips are divided into 10 points, and trading platforms usually show price movements in points. Platforms like MT4 and MT5 show price movement measurements in points. Just remember that 1 pip equals 10 points and you will be fine.

Without understanding the meaning and values of pips and points, it becomes extremely difficult to navigate Forex markets. Pips are the Forex industry’s basic unit of measurement, and traders should memorize its meaning and learn how to calculate its value in USD.

1 pip equals 10 points, and advanced platforms like MT4 and MT5 all show price movements in points. Depending on the lot size, 1 pip may have different values. When trading with 1 standard lot, 1 pip is typically 10 USD. Knowing how much each pip price movement equals is essential for traders to properly manage their risks and understand price movements. It is much easier to say that the price moved by 1 pip rather than with 0.0001 USD.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.