Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Going long or taking a long position simply means buying an asset at a certain exchange rate. This method of buying and selling could be at market price, meaning the position is filled right away or at a predetermined price. If the price of an asset reaches a predetermined level, then the order will get activated and filled. In financial trading of any sort, going long means buying the tradable instrument and holding an open position. There are many methods and strategies for going long, and we are going to discuss this subject in more detail below. So, stay tuned.

Traders usually want to buy an asset cheaply and sell it later expensively, making a profit in the process. The profits made are the differential between buying and selling prices. As you can guess already, going long is the best trading idea during bull or uptrend markets. When prices go higher and higher for extended periods, investors and traders typically track the price and try to jump in by initiating long positions. To clarify this, let’s discuss an example of a buy position in the Forex market.

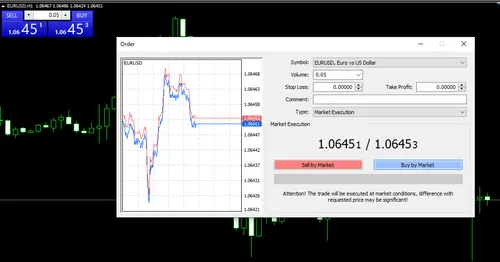

As we can see, going long is a straightforward process in any trading platform. But the steps before trading is possible are several. You will need a trading account with funds to initiate a trading position, be it buy or sell. After you have either a live or a demo trading account, you can initiate a long position by clicking on a buy button. This is true for any trading platform out there, as all of them have an option to buy or sell the asset you want.

The exact steps to initiate a long position are as follows:

Register an account with a reliable broker. Depending on your trading assets, this broker may be a crypto, Forex, or stockbroker.

Depending on the account type, you will need funds before you can start trading. This can be done by depositing funds on the live account or selecting your initial deposit amount on a demo account.

Download the trading account and log in, or access the web trading terminal and log in. The majority of Forex brokers offer advanced trading platforms such as MT4, MT5, cTrader, and TradingView.

Initiating a long position on a demo account is simple and fun, but knowing exactly when to go long and how to manage your risks is a completely different matter. Usually, traders have a well-defined procedure and checklists called trading strategies to go long or short. In case of going long, there are a multitude of trading strategies, but we will focus on the most popular and simple approaches. If you are new to online financial trading, opening a demo account is a must. Do not open a live trading account with real money unless you have a thoroughly tested trading strategy accompanied by a comprehensive risk management plan.

So, if you have a demo account and want to play with financial trading and extended positions, here are popular and simple strategies.

Trend-following strategies are the most popular methods as they are super simple and beginner-friendly. Here are simple steps for trend following strategy:

This one is much more complex than a trend-following strategy, as it relies on technical analysis of advanced concepts. Support and resistance need an explanation of their own, but the basic principle is simple: you place lines on the price levels where the price struggled most. The price could not break above or below the important levels, and it is visible on the charts. After the next breakout of resistance, we enter a long position and use both stop loss and take profit to fix our potential losses and profits.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.