Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Minor currency pairs are Forex pairs that do not include the US dollar. It can include major currencies in Forex, but instead of having USD in the equation, major currencies are quoted directly against each other.

Also known as cross-currency pairs, they are widely traded in the Forex market, as some of them include major currencies such as the Euro, Japanese yen, and the British pound. Most Forex traders classify the cross pairs into major and minor crosses, which broaden your choice of currencies to include CAD, NZA, and AUD.

Minor currencies are backed by well-established economies, which makes them less volatile than exotic currency pairs. However, these pairs that cross over the USD can create some volatility because not all currencies are equally stable.

The volatility of minor currency pairs is variable, depending on the currencies involved in the pair, which requires the Forex trader to carefully consider the trading strategies they choose to use. That’s exactly what we are going to discuss in this guide, along with what determines the prices of these crosses, and how you can trade them.

Forex currency pairs usually include the US dollar as it is the most used and one of the most stable currencies from around the world. In 2019 it was estimated that 88% of all Forex transactions contained the USD.

However, trading currencies in the Forex market without including the USD gives traders a wider selection of currencies to choose from. These major pairs that are traded without the USD are called minor currency pairs, or cross currency pairs because they simply cross over the dollar.

These minor currencies include worldwide currencies such as the Euro, British pounds, Japanese yen, and Swiss franc. These currencies belong to strong economies that facilitate the stability of these currencies.

You might find other variations of these cross currencies, including the New Zealand dollar, Australian dollar, and Canadian dollar. These currencies might be weaker than the primary currencies listed above, but they add to the diversity of the minor currencies.

The interest rate differentials between these currencies lead to volatility in trading these cross pairs, which might look similar to exotic currency pairs. However, the difference is that those cross currencies do not include emerging markets.

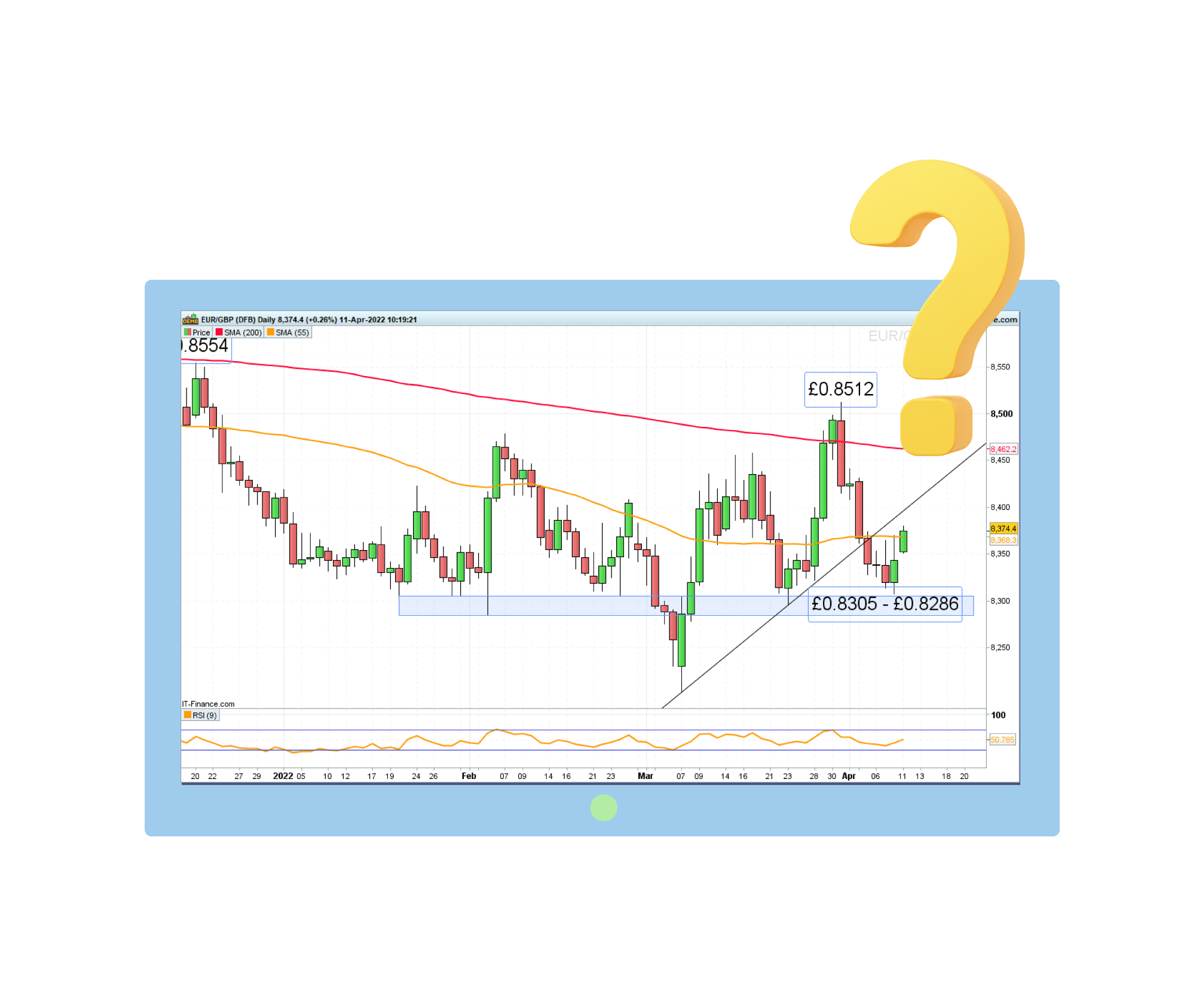

Additionally, the liquidity of these pairs also varies depending on the traded pair. For example, the EUR/GBP is more liquid than the CHF/NZD despite both being named cross pairs. The reason that the EUR/GBP pair is more liquid is that both currencies are geographically located next to each other and there are different trade agreements between them. As such, you can see how the UK and the EU might have more trade happening between them, creating a greater need for currencies to be exchanged, which leads to higher levels of volatility.

Minor currency pairs bring up the best of both worlds. They are reliable since they are supported by strong economies, plus they have higher volatility.

This gives traders a wider selection of pairs that can be traded as cross currency pairs, and we are going to look at some of the commonly traded crosses:

This cross-currency pair is one of the most traded pairs and contains currencies from two strong economies in Europe. In 2016, when the Brexit referendum took place, many traders speculated on this pair, and it was widely traded.

This pair is generally affected by the decision of the local national banks, and economic indicators such as inflation, unemployment, and interest rates. Trade has also become an important matter since the UK departed from the EU.

This minor currency pair is also commonly traded and includes one major currency, the British pound, against the Australian dollar. The GBP has faced quite a bit of fluctuation since Brexit was concluded in 2020.

The Australian economy relies heavily on producing and exporting commodities such as coal, iron ores, and meats, so when the price of these commodities changes, it directly affects the AUD. The GBP is also affected by local interest rates and unemployment statistics.

This currency pair is another top minor currency pair that includes one major currency, the Japanese yen, paired with the New Zealand dollar. The volatility of this cross-currency pair is relatively high due to the different economic indicators between the two economies.

Japan has a stable economy with steady growth and low-interest rates, while the economy of New Zealand is smaller, and relies on exporting several natural resources and dairy products, as well as relying on tourism. It is important to note that recent shifts in the tourism industry have caused higher volatility in this currency pair.

This pair is yet another top cross-currency pair. It includes one of the strongest currencies in Asia and an important currency in North America.

The Japanese economy is stable, its interest rates are low, and the rate of economic growth is steady without any sudden changes. On the other hand, the Canadian economy relies on exporting natural resources and dairy products which can cause economic changes based on the supply and demand of its products.

The Canadian dollar has lately been affected by labor shortages, which changed the pattern of its imports. Additionally, any change in the price of commodities that Canada exports can cause a shift in its currency value.

This minor currency pair includes the stable Japanese yen and the recently recovering Australian dollar. This pair is affected by the price changes of the commodities that Australia exports. The Australian economy relies heavily on exporting natural resources and dairy products.

While the Japanese economy is more stable, it relies on internal economic stability and the low-interest rates of the Bank of Japan to keep its currency stable.

Minor currency pairs are more volatile than the major currencies which include the USD in the pair, and they also provide safety because they do not include emerging or developing markets' currencies. Thus, cross-currency pairs provide an ideal combination.

However, there are many determinants for the volatility and the price of these cross-currencies, including the economic reports and announcements of central banks, commodity prices, and international trade.

Changes in the commodities traded among these countries affect the prices of minor pairs. Commodities traded include natural resources, dairy products, and electronics. Additionally, these currencies are also affected by local economies.

Interest rates, unemployment, inflation, sovereign debt, and economic growth are all indicators that affect the price of these cross-currency pairs. Therefore, there is a wide span of factors that affect the volatility and value of minor currencies.

Liquidity is another factor that defines the price of these currencies, and most of the minor currency pairs have high liquidity. Since the cross-currencies are supported by strong economies, there are many traders who add to the liquidity of these pairs.

Different interest rates of the minor currencies define the parity, or lack thereof, in their exchange prices. For example, the interest rate in Japan is almost 0.1%, while in New Zealand it is 2.25%, which leads to different levels of demand for the currency and different valuations against other currencies.

Additionally, the local political and economic life in these currencies is relatively stable, and there are no political threats to the stability of these currencies. This stands in sharp contrast to exotic currencies, which fluctuate heavily due to political instability.

Traders find a fair bit of gaining opportunities with minor currencies in Forex. They provide higher volatility than major currencies and are more secure than exotics. Forex traders also enjoy the wider range of choices they have with minor pairs, without the need to peg all their investments to the US dollar.

Minor currencies can also be a good portfolio diversification option. A Forex trader may buy several market positions in major, minor, and exotic currencies. This helps the trader diversify their risk portfolio. So, if one major pair is performing badly, there is a good chance that a minor currency pair without the USD is performing well.

Unlike major currencies that move very slightly in one trading session, minor currencies tend to have a wider range in which they fluctuate during the day, meaning that there are higher chances to gain decent profits in one trading session.

Forex brokers have their own fees, which can be either fixed or variable fees that are paid every time you enter and exit the market. When you trade minor currency pairs and gain more pips in one trading day, you can exit the market and pay the broker’s fees, while keeping enough profit for you. With major pairs, the fees are often much lower, but the lack of volatility can make it difficult to gain enough pips to pay the fees and make a good profit.

Minor currencies in Forex can be targeted for short-term or long-term gains, it all depends on the currency pair you are trading. Therefore, you can choose your trading strategy depending on the expected returns and volatility of the traded pair.

If you are trading EUR/GBP, EUR/CAD, EUR/NZD, and EUR/AUD, you can choose a long-term trading strategy because these pairs have low volatility. You can trade using a position trading strategy, swing trading strategy, or range trading strategy.

However, if you prefer AUD/JPY, NZD/JPY, CAD/JPY, and AUD/CHF, a short-term trading strategy can be more appropriate, as these are pairs with relatively high volatility. You can trade these using a day trading or scalping strategy.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Major pairs are pegged to the US dollar since the USD is the currency of world trade, while the minor pairs quote different currencies against each other without the USD. USD/JPY is considered a major currency pair, while EUR/JPY is a minor currency pair.

Minor currency pairs include the New Zealand dollar, the Australian dollar, and the Canadian dollar. These countries’ economies have recovered lately and have fairly stable currencies.

Some traders consider cross pairs in Forex more secure than exotic pairs. Exotic pairs are very volatile, and the price can change suddenly and severely due to political instability and an unstable economy. However, the minor currencies include stronger or recovering economies that have a more stable political situation.

As it goes for every other pair in the Forex market, the demand for and supply of currencies shape the pricing of the currency pairs. The minor currencies are affected by local economic conditions such as interest rates, inflation rates, and unemployment statistics. They are rarely affected by geopolitical changes.