Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Oil and gas have long been two of the most important commodities for nations big and small. The rapid industrialization of developing countries has skyrocketed the global demand for oil and other hydrocarbon products.

Despite global efforts to shift away from oil into renewable electricity sources, it still remains a vital part of the economies of pretty much every country on the planet.

For this very reason, many investors have either already added, or are considering adding oil into their long-term investment portfolios.

For beginner investors, it is crucial to understand how the global oil market works, what threats and opportunities it faces in the long run, as well as the process and many approaches to investing in oil. Understanding these factors can help investors decide whether oil and related companies and funds are worth investing in, and how the global economy might handle the gradual transition from hydrocarbons to renewable energy.

If you are an investor interested in investing in oil and natural gas but don’t know where to start and what to look out for - this investfox guide on oil investments is for you.

Before diving deeper into investment approaches, it is crucial to understand the key players in the global oil and gas industry, as well as the multitude of factors that affect the price of oil around the globe.

The global oil market is a complex web of buyers, sellers, and intermediaries that facilitates the trading of crude oil and petroleum products worldwide. The market operates in accordance with supply and demand principles, which gives countries with large proven oil reserves a major advantage in the market.

The general operations of the global oil market can be broken down as follows:

An important factor in the global oil market is the OPEC group of countries. OPEC, or the Organisation of Petroleum Exporting Countries, is an international organization that enables cooperation between some of the largest oil-producing countries in the world.

OPEC consists of 13 member countries - Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates, and Venezuela.

The individual decisions of member states, as well as the geopolitical relations between them, are crucial factors impacting the global supply of oil. It must also be noted that many of the member states are not characterized by geopolitical stability, whether it be internal or external affairs.

Some of the core functions of OPEC include:

While OPEC may be the largest organization of oil producers, a bulk of its production capacity is concentrated in Saudi Arabia, with the state-owned Saudi Aramco being the single largest oil company in the world.

The USA dominates the global production output - producing almost 12 million barrels of oil every day.

Possibly the most important consideration for oil investors are the factors that affect global oil prices. Anything that can greatly disrupt or boost the global demand or supply of oil has the potential to affect oil prices in a major way, which in turn affects the global economy as a whole.

Some major factors that can affect oil prices include:

As with other commodities, investors can choose different methods when investing in oil. Some investors have long-term expectations regarding the price of crude oil, while others may want to take advantage of short-term supply or demand-side shocks on the market.

Investors and traders alike can choose between a plethora of oil-related exchange-traded funds (ETFs), stocks, or commodities futures to meet their objectives.

Oil futures allow market participants to buy or sell a specific amount of crude oil or petroleum products at a predetermined price and delivery date in the future. These contracts are traded on major commodities exchanges, such as the New York Mercantile Exchange (NYMEX) or the Intercontinental Exchange (ICE).

Each futures contract specifies certain parameters, including the type of oil, quantity, quality, delivery location, and delivery month. A common oil futures contract may include the delivery of 1,000 barrels of West Texas Intermediate (WTI) crude oil, which is the most popular type of crude oil traded and observed in the western hemisphere.

Market participants can take either long or short positions in oil futures, depending on their expectations.

Oil futures contracts are quoted in terms of the price per barrel of oil. For instance, a contract may be priced at $70/barrel.

Futures trading also allows participants to leverage their capital, which requires them to deposit an initial margin. The initial margin is a percentage of the contract value and serves as collateral and helps cover potential losses.

Oil producers also use futures to hedge against expected price fluctuations to secure their bottom line. Futures trading involves considerable risk and is generally not advisable for complete beginners.

One of the more popular ways of investing in oil is by buying shares in major oil companies. Most oil companies around the world are either private corporations or state-owned monopolies. Either way, they are commonly traded on major stock exchanges, where investors can easily buy and sell their shares.

Saudi Aramco, the largest oil company in the world, is a state-owned enterprise, which also trades a small portion of its share capital on the Saudi Exchange, under the ‘2222’ ticker.

Conversely, corporations with a global presence, such as ExxonMobil, Shell, BP, Total, etc. are all publicly listed companies with hundreds of billions of dollars in market capitalization between them.

As of May 2023, the top 10 largest oil companies in the world by market capitalization were:

Many major oil companies also pay dividends on their stock, which is another added benefit to investing in oil stocks for the long term.

Exchange-traded funds are some of the most popular ways of investing in equities. Oil ETFs invest in commodities that vary in terms of production, region, risk exposure, etc.

Oil ETFs allow investors to gain exposure to a diverse lineup of oil company stocks and commodities, which disperses the risk exposure of holding these assets.

Having a broader exposure to the global oil industry allows investors to shield their investments from geopolitical risks. For instance, internal political tensions in a major oil producer may affect the oil supply in that country. However, if an investor holds their capital ETFs, this allows them to mitigate the downside risks arising from that region.

Oil ETFs tend to be easily accessible and low-cost, which is convenient for the global investment community.

There are a number of easily accessible oil ETFs on the market that invest in different oil companies and indices. Some oil ETFs are actively managed and make adjustments frequently, while others track commodity indices, or the price of crude oil, such as the WTI.

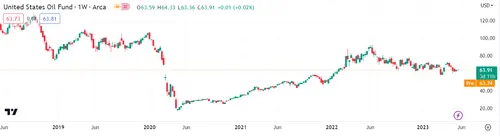

The United States Oil Fund (USO) is a major oil ETF that aims to track the price of WTI crude oil. It is one of the most widely recognized and traded oil ETFs in the United States.

The fund's primary objective is to provide investors with exposure to the spot price of WTI crude oil by holding futures contracts and other oil-related investments.

USO is structured as a commodity pool and a grantor trust. The fund’s assets consist mainly of WTI crude oil futures contracts listed on the New York Mercantile Exchange (NYMEX), as well as other oil-related investments, such as cash-settled options on WTI crude oil futures.

USO is traded on the NYSE Arca and is one of the most popular oil ETFs for both long-term investors and short-term traders.

The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) is an exchange-traded fund that tracks the performance of oil companies in the United States, such as the EQT Corporation, Range Resources Corporation, Chord Energy Corporation, Denbury Inc, etc.

These companies make up the S&P Oil & Gas Exploration & Production Select Industry Index.

The index has a diverse composition of oil companies in the U.S. and gives investors exposure to a diversified portfolio of oil-producing companies.

The fund has been one of the top gainers since March 2020 - rising from $33 to over $125 in 2023.

The Vanguard Energy ETF is an exchange-traded fund that aims to track the performance of the MSCI US Investable Market Energy 25/50 Index, which represents the broader U.S. energy sector.

The index is composed of large, mid, and small-cap companies in the U.S. energy sector and is weighted by market capitalization.

The fund is invested in some of the largest oil companies in the world, including ExxonMobil (XOM), which accounts for 23.75% of the fund’s capitalization.

Other notable constituents of the fund include Chevron (16.27%) and ConocoPhillips (6.67%).

The Vanguard Energy ETF aims to closely replicate the performance of its underlying index by investing in a portfolio of securities that closely match the index's composition and weightings. However, due to factors such as expenses, tracking errors, and market conditions, there may be slight differences between the ETF's performance and the index it tracks.

The Alerian MLP ETF tracks the performance of the Alerian MLP Infrastructure Index. The ETF is designed to provide investors with exposure to Master Limited Partnerships (MLPs) that own and operate energy infrastructure assets.

Some major holdings of AMLP include the Magellan Midstream Partners LP (14.45%), the Plains All American Pipeline LP (12.74%), and the Enterprise Products Partners LP (12.35%).

MLPs are known for their potential to generate income through the distribution of cash flows to their unitholders. The Alerian MLP ETF can provide investors with exposure to these potential income streams, as MLPs often distribute a significant portion of their cash flows in the form of regular distributions.

The Energy Select SPDR Fund, or XLE, is an ETF that seeks to track the performance of the Energy Select Sector Index, which consists of some of the largest energy stocks in the S&P 500.

ExxonMobil (XOM) accounts for 23.37% of the ETF’s total weighting, while Chevron Corporation (CVX) comes second with 19.84%.

The fund is one of the most popular energy ETFs among stock investors, as it provides a diverse exposure to the United States’ resilient oil and gas industry. The ETF is traded on the NYSE Arca exchange.

Oil investing comes with its fair share of benefits and risks and investors should carefully consider these factors before pledging their capital to various oil-related financial instruments.

When investing in oil and related financial instruments, investors must keep in mind that market trends are constantly changing and evolving and so is the financial standing of some of the largest oil producers in the world.

The global oil and gas industries are highly flexible and risk-averse investors may find themselves frustrated by the constant developments in the market.

Market trends can be influenced by major shifts in a policy of either the largest producers of oil and petroleum products or of the largest consumer markets.

For example, political instability in countries such as Saudi Arabia or russia can greatly impact the global oil supply. Conversely, changing demand patterns in the United States, India, and China, can affect the global demand for oil as well, as they are the largest consumer markets in the world.

Experts often make forecasts for crude oil prices and investors are advised to keep track of forecasts, as they take a multilayered approach to estimating global oil prices over the short and long term. However, it is important to note that long-term forecasts for commodities tend to be less reliable, as they fail to consider unexpected disruptions that may be caused by environmental and geopolitical factors.

When investing in the stock of oil companies, or ETFs tracking the performance of oil companies, it is crucial to keep track of their financial results, which are posted quarterly and annually. Some important data to look out for include gross revenues, net income, profit margins, price/earnings ratio, etc.

Financial and operational reports lay out the actual performance and future goals of the company, which can give investors important insight into the long-term viability of their stock.

Global environmental policy has become a crucial part of energy investments and infrastructure. As the world grapples with climate change and countries adopt regulations that are more favorable to renewable energy, the long-term demand for oil and natural gas remains in limbo for some analysts. While the short-term implications of such a transition may not be as evidently noticeable for investors, the global renewable energy infrastructure is expanding rapidly and some countries have unveiled plans to ban the sale of internal combustion engines, which can greatly impact the global demand for oil.

Such developments are important to consider when investing in oil and related financial instruments.

Once you have decided on your preferred method of oil investment, you can start the technical process of allocating your capital to the investments that you deem desirable.

If you don’t already have a brokerage account, you can choose from dozens of platforms that offer different fee structures and additional features you can take advantage of.

Once you have chosen a brokerage company, open an account with them using your credentials and general financial and legal information. Verify your identity, source of funds, and residence and you can move to funding the account to start investing.

You can also choose brokerages that charge no trading fees and allow fractional shares, which is especially convenient for investors with little capital.

Once your brokerage account is up and running, you can devise an investment strategy by deciding what to invest in and how frequent your investments should be. Are you investing as a one-time lump sum or do you prefer dollar-cost averaging? These are important questions to ask when investing in any financial instrument.

Your investment strategy will also vary greatly depending on which oil-related investments you are prioritizing. For instance, oil stocks also pay attractive dividends, while futures contracts and options may lead to much higher gains over shorter intervals.

Building your portfolio entails choosing the specific assets you would like to invest in. A balanced oil portfolio should consist of a mix of oil stocks, diversified indices, and actively managed funds. You can also choose to set aside a portion of your capital for short-term trades, while your long-term portfolio continues to accumulate gains. For example, you may allocate 10-20% of your capital for oil futures trading, while the rest is diversified across oil company stocks and index ETFs.

Making an investment is not the final step in the process. Investments require constant attention and monitoring to be able to make quick adjustments in accordance with market conditions.

An investment that seems profitable now may not prove to be so in the future, which makes rebalancing efforts all the more important.

To simplify the monitoring process, you can use one of many portfolio tracking solutions that give you a bird’s eye view of all of your investments.

Keeping track of commodity market news is crucial in understanding the direction of your investments and whether you need to make adjustments to your portfolio or not. The global oil market is constantly changing and keeping track of major developments in some of the largest oil-producing countries in the world can be the difference between gains and losses.

When the market is swinging broadly opposite of the desired direction, you may want to make adjustments and rebalance your portfolio to the desired aggregate risk exposure.

This may involve closing some positions altogether while doubling down on others or introducing completely fresh ones.

How you choose to approach the rebalancing of your portfolio will largely decide the long-term performance of your investments.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Oil is the most popular commodity in the world, alongside gold. Oil has long been viewed as an inflation hedge and with its high volatility, it opens up profitable opportunities for short-term trades, which is why oil futures remain in high demand.

Investing in oil can be done in a few ways. You can trade oil futures and options, or invest in the stocks of oil companies from around the world. Many exchange-traded funds track global and regional energy indices, which are often predominantly composed of oil and natural gas companies.

Saudi Aramco is the largest oil company in the world by some margin. The Company has a market capitalization of over $2 trillion and is the state-owned oil monopoly of Saudi Arabia - the largest oil-exporting member of OPEC.