In Switzerland, Forex trading is legal and regulated by the Swiss Financial Market Supervisory Authority (FINMA). FINMA is one of the most reputable and reliable regulators, providing maximum levels of safety for Swiss Forex traders. Despite robust local regulations, Forex traders in Switzerland can always opt for brokers that are regulated in any of the EU countries. The notable regulators in the EU countries include several countries such as Germany BaFin, the UK FCA, Cyprus CySEC, and so on.

Switzerland does not have a capital gains tax, as all the trading profits in the country are tax-exempt.

FINMA also restricts and regulates the maximum leverage for retail traders. The maximum leverage for retail clients is 1:30 for the major currency pairs and 1:20 for non-major currency pairs. The maximum leverage for professional traders is not as restricted and depends on the Forex broker. Switzerland does not have a specific compensation scheme or insurance program for traders similar to the deposit protection schemes in some other countries.

The best Forex brokers in Switzerland

XM

Read the review

Visit broker 8.4 8.34 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.03% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Dukascopy

Read the review

Visit broker 6.72 0 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

AvaTrade

Read the review

Visit broker 8.8 7.63 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Pepperstone

Read the review

Visit broker 8.2 7.75 Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

| ||

| Regulated by FINMA | No | Yes | No | Yes | No |

| Offers accounts in Switzerland under | CySEC | FINMA | Central Bank of Ireland | FINMA | CySEC |

| Account entity for Swiss residents | Trading Point of Financial Instruments Limited | Dukascopy Bank SA | AVA Trade EU Ltd | Swissquote Ltd | Pepperstone EU Limited |

| Offers accounts in Swiss Franc | Yes | Yes | Yes | Yes | Yes |

| Offers retirement account | No | Yes | No | Yes | No |

| Offers Swiss stocks | Yes | Yes | No | Yes | Yes |

| Spreads on USDCHF | From 2 pips | From 1.2 pips | From 1.6 pips | From 2.5 pips | From 0 pips |

| Spreads on EURUSD | From 0.6 pips | From 0.3 pips | From 0.9 pips | From 1.7 pips | From 0 pips |

| Maximum Leverage | 1:30 for Switzerland(1:400 for pros) | 1:30 | 1:30 retail(1:400 for pros) | 1:1 | 1:30 for retail, 1:500 for pros |

| Minimum Deposit | 5 CHF | 100 CHF | 100 CHF | 1,000 CHF | 0 CHF |

| Deposits via cards and PayPal | Yes | Yes | Yes | Yes | Yes |

| Desktop Trading Platforms | MetaTrader 4 and 5 | MT4, MT5, jForex | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade | eTrading, ESG investing, Mobile III | cTrader/MetaTrader 4&5 |

More about the top 5 FX brokers in Switzerland

XM

XM is a very reputable Forex and CFDs broker that offers trading services to EU residents, including Switzerland. While not directly under FINMA regulations, XM is regulated by reputable regulators in Cyprus and the UK, enabling it to also include Switzerland in its accepted countries list.

There are several aspects why XM might be the suited broker for Swiss traders. It accepts deposits in Swiss Francs and offers Swiss stocks for trading with competitive spreads. Switzerland's citizens also love gold trading, and XM has one of the lowest spreads for XAUUSD in the industry, making it very attractive. The spreads on XAUUSD start from 0.29 points, which is below industry standards.

Below is the list of the trading assets offered by XM:

- 50 Forex pairs

- 58 Cryptocurrencies

- 1000+ stock CFDs

- 7 turbo stocks

- 8 commodities

- 20 indices

- 3 precious metals

- 3 energies

Visit broker

8.4

8.34

| Micro | Standard | XM Ultra Low | |

|---|---|---|---|

| Spreads on USDCHF | From 2 pips | From 2 pips | From 2 pips |

| Spreads on Gold | From 0.29 | From 0.29 | From 0.29 |

| Spreads on EURUSD | From 1 pip | From 1 pip | From 1 pip |

| Minimum Deposit | 5 CHF | 5 CHF | 5 CHF |

| Offers Swiss Stocks | Yes | Yes | Yes |

| Minimum lot size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum leverage | 1:30 in Switzerland | 1:30 in Switzerland | 1:30 in Switzerland |

| Negative Balance Protection | Yes | Yes | Yes |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 |

Dukascopy

Dukascopy is a bank and Forex and securities broker that is regulated in Switzerland by FINMA and also in Japan. The broker is based in Switzerland and has all the specs suitable for local traders. However, it has a higher deposit and withdrawal fee of 100 USD, which is very expensive. The leverage is at 1:200 for professional traders and 1:30 for retail traders in Switzerland as per regulations. Dukascopy is one of the few brokers that offer binary options, but binary options trading is restricted in Switzerland, so we won’t include them in the list of offered assets.

The broker offers retirement accounts, and CFD trading accounts for both investors and traders in Switzerland, which is very beneficial. However, the spreads for major pairs are not as low for CHF pairs.

Here is the list of tradable instruments provided by the Dukascopy broker:

- 40+ Forex pairs

- 18 cryptos

- 21 indices

- 13 commodities

- 900+ share CFDs

Dukascopy offers Swiss stocks for trading and is currently testing MT5 as a new platform for traders.

Visit broker

6.72

0

| JForex | MT4 | |

|---|---|---|

| Spreads on USDCHF | From 1.2 pips | From 1.2 pips |

| Spreads on Gold | From 0.34 | From 0.34 |

| Spreads on EURUSD | From 0.3 pips | From 0.3 pips |

| Minimum Deposit | 100 CHF or equivalent | 100 CHF or equivalent |

| Minimum lot size | 0.01 lots | 0.01 lots |

| Maximum leverage | 1:30 | 1:30 |

| Negative Balance Protection | Yes | Yes |

| Trading Platforms | MT4, MT5, jForex | MT4, MT5, jForex |

AvaTrade

AvaTrade is a regulated Forex and CFDs broker that is available in Switzerland. While it's not directly regulated by the FINMA it is regulated in three EU countries such as Ireland, Cyprus, and Poland. These regulations allow AvaTrade to freely offer its trading services to the residents of Switzerland as per MiFID II and ESMA regulations. AvaTrade accepts deposits in Swiss Franc. It does not offer stock CFDs for Swiss stocks and has no retirement account for long-term investors. However, the trading services offered by AvaTrade are competitive against other brokers competing in Switzerland's Forex brokers’ market. The minimum deposit required for local traders starts from 100 Swiss Franc. Traders can deposit lower if they select USD as their deposit currency, as the CHF is stronger.

The maximum leverage for local trailers in Switzerland is capped at 1:30 as per EU regulations.

Visit broker

8.8

7.63

| Retail | Professional | |

|---|---|---|

| Spreads on USDCHF | From 1.6 pips | - |

| Spreads on Gold | From 0.3 | From 0.2 |

| Spreads on EURUSD | From 0.9 pips | From 0.1 pips |

| Minimum Deposit | 100 CHF | - |

| Minimum lot size | 0.01 lots | - |

| Maximum leverage | 1:30 | 1:400 |

| Negative Balance Protection | Yes | No |

| Trading Platforms | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

Swissquote

Swissquote is based in Switzerland and offers its trading services to the EU and Switzerland traders. The broker is regulated locally by FINMA and has full authorization to offer Forex, CFDs, and stocks to local and EU traders. Swissquote accepts deposits in Swiss Francs and has multiple accounts targeted for both traders and investors. Traders can start investing and accumulating stocks to get dividends, which is a good option for preserving and growing wealth. As a bank and broker, Swissquote offers over 9,000 ETFs and 30 cryptos and provides traders with access to 50 markets worldwide. It also offers a multitude of Swiss stocks for local traders and investors and allows them to speculate or invest for the long term with dedicated accounts. There are more than 130 Forex pairs to choose from. Swissquote offers several trading platforms eTrading, ESG investing, and Mobile III. Unfortunately, there are no MT4, MT5, or any other popular advanced platforms offered as of now.

| Standard | Premium | Professional | |

|---|---|---|---|

| Spreads on USDCHF | From 2.5 pips | - | - |

| Spreads on Gold | From 0.23 | - | - |

| Spreads on EURUSD | From 1.7 pips | - | - |

| Minimum Deposit | 1,000 CHF | 10,000 CHF | 50,000 CHF |

| Minimum lot size | 0.01 lots | 0.01 lots | - |

| Maximum leverage | 1:30 | - | - |

| Negative Balance Protection | Yes | No | No |

| Trading Platforms | eTrading, ESG investing, Mobile III | eTrading, ESG investing, Mobile III | eTrading, ESG investing, Mobile III |

Pepperstone

Pepperstone is a regulated Forex and CFDs broker that offers trading services for citizens of Switzerland. The broker is not directly regulated by the FINMA but has licenses in other EU countries including Cyprus and Germany. The broker accepts deposits in Swiss Francs and has competitive spreads on CHF currency pairs. Pepperstone does not offer Swiss shares, but a handful of stocks from other exchanges are provided on the MT4, cTrader, and MT5 platforms.

Visit broker

8.2

7.75

| Razor | Standard | |

|---|---|---|

| Spreads on USDCHF | From 0 pips | From 1 pip |

| Spreads on Gold | From 0.5 | From 0.5 |

| Spreads on EURUSD | From 0 pips | From 1 pip |

| Minimum Deposit | 0 CHF | 0 CHF |

| Minimum lot size | 0.01 lots | 0.01 lots |

| Maximum leverage | 1:30 for retails, 1:500 for professionals | 1:30 for retails, 1:500 for professionals |

| Negative Balance Protection | Yes (for retails only) | Yes (for retail traders) |

| Trading Platforms | MT4, MT5, cTrader & TradingView | cTrader/MetaTrader 4&5 |

Best choice of the broker in Switzerland per category

Out of the top five Forex brokers, some might be better at spreads while others are better in fees and several offered assets. Let’s rank the brokers to select the most suited one in each category of Forex trading, share CFDs trading, and Crypto CFDs.

Best Broker in Switzerland for Forex Trading

| XM | Dukascopy | AvaTrade | Swissquote | Pepperstone | |

|---|---|---|---|---|---|

| Number of Forex pairs | 50 | 40 | 64 | 130+ | 62 |

| Spreads on USDCHF | From 2 pips | From 1.2 pips | From 1.6 pips | From 2.5 pips | From 0 pips |

As we can see the best spreads offered for USDCHF currency pairs are offered by Pepperstone, while Swissquote offers 130+ pairs.

Best Broker in Switzerland for Share CFD Trading

| XM | Dukascopy | AvaTrade | Swissquote | Pepperstone | |

|---|---|---|---|---|---|

| Number of Stock CFDs | 1000+ | 900+ | 700 | - | - |

| Commissions | From 0 points | From 4 | From 0.3 USD plus 0.13% commission | 0.15% commission, USD 0.03 | - |

XM is the best broker for share CFDs because of how low spreads and commissions it has.

Best Broker in Switzerland for Crypto CFD Trading

| XM | Dukascopy | AvaTrade | Swissquote | Pepperstone | |

|---|---|---|---|---|---|

| Number of Crypto CFDs | 31 | 18 | 19 | 30+ | 23 |

| Commissions | From 0.0017. Spreads on BTC/USD start from 39 | 52.5 per million traded | From 0.20% | From 0.5% | 33.97 Avg spread on BTC/USD |

XM stands out when it comes to crypto CFDs as it offers the lowest spreads and the highest number of crypto instruments.

How to check if the broker is regulated by FINMA or any other EU regulator?

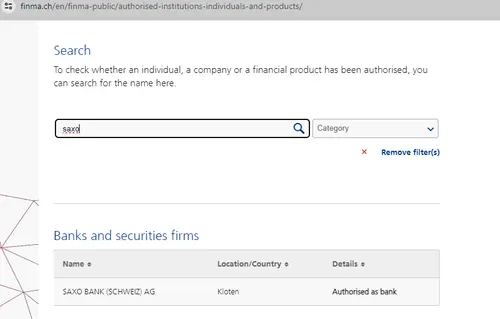

The easiest way to ensure the broker offers services in Switzerland is to check our list of brokers, or if any of the EU-based regulators regulate your preferred broker. To directly check if the broker is regulated by the FINMA below is the step-by-step guide.

Step 1: Go to the FINMA website

Just type search for FINMA’s official website (finma.ch) and locate the Public tab on the right side.

Step 2: Go to the FINMA Public page

From the main page, find the tab for FINMA Public, and click on it. You will be redirected to the page where you can find the authorized companies button.

Step 3: go to the authorized companies page

After clicking on the authorized companies button, scroll down to find the search bar, where you can find all the brokers that are regulated and licensed by FINMA.

All FINMA-regulated Forex Broker Reviews

Below is the list of all Forex brokers that are regulated by the FINMA of Switzerland.