Nigeria has a well-developed financial system, with a multitude of reputable brokers offering their services. The entity in Nigeria is the Securities and Exchange Commission (SEC). Despite its own regulator many popular brokers prefer to offer their services under regulations of other African countries. African regulators who might be suitable for Nigerian Forex traders include South African regulators the Financial Sector Conduct Authority (FSCA), Mauritius offshore regulator Financial Services Commission (FSC), and Kenya’s Capital Markets Authority (CMA). Nigerian Forex brokers can freely select a broker that is regulated by any of the mentioned entities.

The official language of Nigeria is English and brokers offer only this language despite many local languages.

Capital gains tax is 10% in Nigeria, taxing all Forex traders who make profits in financial trading. For professional traders, it might be a better idea to opt for neighboring countries without capital gains taxes.

Popular payment systems in Nigeria are several, but bank cards are most noteworthy, which are accepted by all brokers in the list below.

Quick overview of the best Forex brokers in Nigeria

Below, we have selected some of the best Forex brokers for Nigerian traders that are regulated in the African continent and offer attractive conditions.

Tickmill

Read the review

Visit broker 7.6 6.29 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd. You should consider whether you understand how CFDs or our other products work and whether you can afford to take the high risk of losing your money.

|

AvaTrade

Read the review

Visit broker 8.8 7.63 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Pepperstone

Read the review

Visit broker 8.2 7.75 Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

|

HFM

Read the review

Visit broker 7 5.86 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.77% of retail investor accounts lose money when trading CFDs with HF Markets (Europe) Ltd. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

FP Markets

Read the review

Visit broker 6.88 4.98 Trade Responsibly: Derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us.

| |

| Offers accounts in Nigeria under | Seychelles | B.V.I | Kenya | - | Seychelles |

| Account entity for Nigerians | Tickmill Ltd | Ava Trade Markets Ltd | Pepperstone Markets Kenya Limited | HFM Nigeria | First Prudential Markets Limited |

| Spreads on EUR/USD | From 1.6 pips | From 0.9 pips | From 0 pips | From 0.0. Avg. spread on EUR/USD 1.3 pips | From 1.1 pips |

| Spreads on Oil | From 0.04 | From 0.03 | From 0.5 | From 0.09 | From 0.02 |

| Spreads on Gas | From 0.004 | From 0.005 | From 8 | - | From 0.02 |

| Spreads on Gold | From 0.09 | From 0.29 | From 0.5 USD | from 0.25 USD | From 0.22 USD |

| Maximum Leverage | 1:500 | 400:1 | 400:1 | 1:1000 | 1:500 |

| Minimum Deposit | 100 USD/EUR/GBP | 100 USD | 0 USD | 5 USD on Micro account | 100 USD or equivalent |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4 and 5, DupliTrade | MetaTrader 4 and 5, cTrader | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, cTrader |

Tickmill

Tickmill is a popular Forex and CFDs broker available in Nigeria. The legal entity that receives clients from Nigeria is Tickmill Ltd and its 100% owned subsidiary Procard Global Ltd, and it falls under the regulations of the Financial Services Authority of Seychelles. Despite being regulated in South Africa as well, Tickmill accepts Nigerian Forex traders under the Seychelles' less strict regulations that are very flexible for local traders. Procard Global Ltd is registered in the UK but is owned by Tickmill Ltd which operates in Seychelles.

Tickmill offers a multitude of trading instruments in a wide range of asset classes:

- 62 Forex pairs

- 9 cryptos

- 25 indices

- 7 commodities

Tickmill offers several commodities that are attractive for Nigerian Forex traders as their country is one of the major petroleum exporting countries in the region. Spreads on Brent Oil start from 0.04 and 0.004 on the Gas. Gold has spread from 0.09. Nigerian traders might also be interested in GBP/USD spreads which is one of the lowest in the industry from 0.3 pips. Since Nigerian retail traders are served under Seychelles regulations they can enjoy a maximum of 1:500 leverage which can be super beneficial for traders with small budgets.

Visit broker

7.6

6.29

| Pro | Classic | VIP | |

|---|---|---|---|

| Spreads on GBP/USD | From 0.1 pips | From 2.1 pips | From 0.1 pips |

| Spreads on EUR/USD | From 0 pips (2 per side per 100k) | From 1.6 pips | From 0 pips (1 per side per 100k) |

| Spreads on oil | From 0.04 | From 0.04 | From 0.04 |

| Spreads Gas | From 0.004 | From 0.004 | From 0.004 |

| Spreads on Gold | From 0.09 | From 0.09 | From 0.09 |

| Minimum Deposit | 100 USD/EUR/GBP | 100 USD/EUR/GBP | - |

| Maximum Leverage | 1:500* | 1:500 | 1:500 |

| Negative Balance Protection | Yes | Yes | - |

| Minimum Lot Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

- This leverage is maximum for retails and professionals, as Seychelles has less stringent regulations for leverage.

AvaTrade

AvaTrade is a reputable Forex and CFDs broker that operates in the African continent. Despite Ava Capital Markets Pty being regulated by the South African Financial Sector Conduct Authority (FSCA), the broker offers its services to Nigerian Forex traders under international regulations.

Ava Trade Markets Ltd which is available in Nigeria is regulated by the B.V.I Financial Services Commission. The main advantage of falling under BVI regulations is that Nigerian retail Forex traders can get maximum leverage of 1:400 which is not the case for South Africa as its regulator restricts maximum leverage.

More than 1250 trading instruments in various asset classes are available for trading at AvaTrade, including

- 64 Forex pairs

- 629 shares as CFDs

- 19 cryptocurrencies as CFDs

- 30 indices

- 17 commodities

Nigerian Forex traders might want to know spreads on commodities including oil, gas, and gold. The spreads on AvaTrade are attractive, Crude oil starts from 0.03 USD, Brent Oil from 0.01 USD, Heating Oil from 0.027 USD, Gasoline from 0.01 USD, Natural gas from 0.005 USD, and Gold from 0.29 USD. AvaTrade Gold spreads are actually very competitive, as anything below 0.3 for gold can be considered a low spread. GBP/USD spreads start from 1.5 pips, which is also very attractive.

Visit broker

8.8

7.63

| Standard Account | |

|---|---|

| Spread on EUR/USD | 0.9 pips |

| Spreads on Oil | From 0.03 |

| Spreads on Gas | From 0.005 |

| Spreads on Gold | From 0.29 |

| Minimum Deposit | 100 USD |

| Islamic Account | Yes |

| Minimum Lot Size | 0.01 lots |

| Negative Balance Protection | Yes |

| Trading Platforms | MetaTrader 4, MetaTrader 5, DupliTrade |

Pepperstone

Pepperstone is available in Nigeria through its subsidiary Pepperstone Markets Kenya Limited that is regulated by the Capital Markets Authority (CMA) of Kenya. The broker offers 1:400 leverage to retail Forex traders in Nigeria as well, as the Kenyan CMA is not strict with the retail Forex leverage. This gives Nigerian traders an advantage to use maximum leverage on low deposit accounts.

Pepperstone provides its traders with advanced trading platforms MT4, MT5, and cTrader. Over 1,200 instruments can be traded at Pepperstone, including:

- 62 currency pairs

- 1,000+ share CFDs

- 23 crypto CFDs

- 32 commodities

- 23 indices

GBP/USD on the Razor account has typical spreads of 0.4 pips, while it is 1.4 on average on standard account. The leverage for Nigerian Forex traders is 1:400 for all FX pairs. Spreads on gold start from 0.5 USD, which is expensive when compared to other brokers in this list. The spreads for gasoline are from 8.00, Natural Gas from 0.5, and Brent Oil and Crude oil from 0.5 as well.

Visit broker

8.2

7.75

| Razor account | Standard account | |

|---|---|---|

| Spreads on EUR/USD | From 0 pips | From 1 pip |

| Spreads on Oil | From 0.5 | From 0.5 |

| Spreads on Gas | From 8 | From 8 |

| Spreads on Gold | From 0.5 USD | From 0.5 USD |

| Commissions | AUD 3.50 (AUD 7 round turn) | No |

| Minimum Deposit | 0 USD | 0 USD |

| Negative Balance Protection | Yes | Yes |

| Maximum Leverage | 1:400 (1:200 for retail traders) | 1:400 (1:200 for retail traders) |

| Islamic Account | No | Yes |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, MetaTrader 5, cTrader |

HFM

HFM has a dedicated support team for Nigerian traders, which is super nice. The broker also has an educational center in Nigeria offering teaching courses to local beginner FX traders. Clients from Nigeria fall under the company’s subsidiary HFM Nigeria, which is not yet regulated by local authorities, however, other HFM companies are regulated by several regulators. HFM support was not able to clarify under which regulator HFM Nigeria operates, and we assumed they are not yet regulated in Nigeria. Despite lacking local regulations, HFM might be a reputable broker in Nigeria still.

On the MT4 and MT5 platforms, traders can speculate on the number of trading assets, such as:

- 53 Forex pairs

- 2,170 shares

- 11 indices

- 13 commodities

HFM spreads on commodities are competitive for Brent Oil from 0.04 and Crude oil from 0.09 and gold from 0.25 USD. HFM is one of few brokers that offer Cocoa trading as well, with spreads from 10. Unfortunately, the broker does not offer Natural Gas or any Gas products, as of now. Spreads on GBP/USD start from 1.6 pips, which is also very competitive for this major pair.

Visit broker

7

5.86

| Cent | Zero | Pro | Premium | Top-Up Bonus | |

|---|---|---|---|---|---|

| Spreads on EUR/USD | From 1.2 pips | From 0 pip | From 0.6 pips | From 1.2 pips | From 1.4 pips |

| Spreads on Oil | From 0.09 | From 0.09 | From 0.09 | From 0.09 | From 0.09 |

| Spreads on Gas | - | - | - | - | - |

| Spreads on Gold | from 0.25 USD | from 0.25 USD | from 0.25 USD | from 0.25 USD | from 0.25 USD |

| Commissions | 0 USD | 6 USD round turn | 0 USD | 0 USD | 0 USD |

| Minimum Deposit | 0 USD | 0 USD | 100 USD | 0 USD | 0 USD |

| Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

| Maximum Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 | 1:1000 |

| Islamic Account | Yes | Yes | Yes | Yes | No |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

FP Markets

FP Markets is a regulated broker that is available in Nigeria. It offers tradable instruments ranging from Forex to stocks. The exact list of all tradable instruments is

- 63 Forex pairs

- 11 cryptos

- 16 indices

- 11 commodities

- 10,000+ other instruments, including stocks

Despite being regulated by the South African FSCA, the broker offers its services to Nigerian traders under the regulations of the Seychelles Financial Services Authority (FSA). While the South African regulator is strict and limits maximum leverage for retail Forex trailers, Seychelles allows Nigerian traders to get the full advantage of the maximum leverage offered by FP Markets, which is 500:1. The entity that is operating accounts under Seychelles FSA is First Prudential Markets Limited.

Spreads on GBP/USD start from 1.4 pips for standard and 0.4 pips for raw accounts. Spreads on Gold start from 0.22 USD, Brent Crude Oil starts from 0.02, and Natural Gas also comes with 0.02 spreads.

Visit broker

6.88

4.98

| Standard | Raw | |

|---|---|---|

| Spreads on EUR/USD | From 1.1 pip | From 0.1 pips |

| Spreads on Oil | From 0.02 | From 0.02 |

| Spreads on Gas | From 0.02 | From 0.02 |

| Spreads on Gold | From 0.22 USD | From 0.22 USD |

| Commissions | No commission | 3 USD per side per 100k traded |

| Minimum Deposit | 100 USD or equivalent | 100 USD or equivalent |

| Negative Balance Protection | Yes | Yes |

| Maximum Leverage | 1:500 | 1:500 |

| Minimum lot size | 0.01 lots | 0.01 lots |

| Islamic Account | Yes | Yes |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, MetaTrader 5, cTrader |

Best choice of the broker in Nigeria by category

As we can see, the choice to select the most suitable broker in Nigeria can be a tricky one, as all brokers in our list are reputable and competitive companies. This is why we are providing tables below where brokers are listed and selected for Forex trading, metals trading, and energies trading.

Best Broker in Nigeria for Forex Trading

| Tickmill | AvaTrade | Pepperstone | HFM | FP Markets | |

|---|---|---|---|---|---|

| Number of Forex pairs | 62 | 64 | 62 | 53 | 63 |

| Spreads on EUR/USD | From 1.6 pips | From 0.9 pips | From 1 pip | From 1.2 pips | From 1.1 pips |

| Spreads on GBP/USD | From 2.1 pips | From 1.5 pips | From 1.4 pips | From 1.6 pips | From 1.4 pips |

As we can see, AvaTrade is almost uncontested when it comes to Forex spreads, except the GBP/USD where Pepperstone and FP Markets offer a bit lower 1.4 pips.

Best Broker in Nigeria for Gold Trading

| Tickmill | AvaTrade | Pepperstone | HFM | FP Markets | |

|---|---|---|---|---|---|

| Spreads on Gold | From 0.09 | From 0.29 USD | From 5 | From 0.25 | From 0.22 USD |

Tickmill offers lowest spreads on Gold (XAUUSD) trading.

Best Broker in Nigeria for Energies trading

| Tickmill | AvaTrade | Pepperstone | HFM | FP Markets | |

|---|---|---|---|---|---|

| Spreads on Oil | From 0.04 | From 0.01 | 2.5 | From 0.04 | From 0.02 |

| Spreads on Natural Gas | From 0.004 USD | From 0.005 USD | From 0.5 | N/A | From 0.02 |

For trading various energies instruments, FP Markets has a slight edge over Tickmill and AvaTrade which also offer low spreads for energy commodities. HFM does not offer natural gas at this point, but it offers oil from 0.04 spreads.

How to check if the broker is regulated by the Nigerian SEC

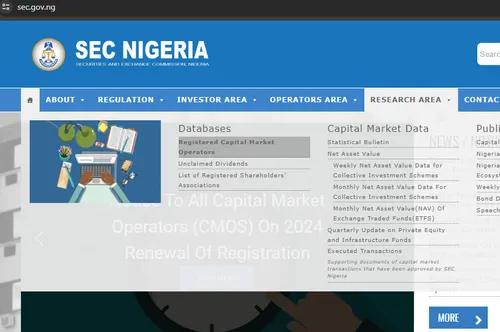

The website of the Securities and Exchange Commission of Nigeria (SEC) offers a database to browse and search for all the regulated brokers and financial service providers in the country.

Step One: Visit the official website of the SEC

To search for all regulated brokers in Nigeria, traders have to visit the official website (https://sec.gov.ng/). On the website, there are several different tabs, and we want to click on the Research Area section.

Step two: Browse and Search in the SEC database

Under the Research Area section, there is a “Registered Capital Market Operators” button. Click on this button, and you will be redirected to the search page, where you can search for all their regulated entities in the SEC’s database.

Step Three: type the name of the broker you want to check

This one is self-explanatory after the website redirects you to the scratch page just type the name, and you will see if the broker is regulated by the SEC.

All Nigerian SEC-regulated Forex Broker Reviews

To see and read the reviews of all Forex brokers that are regulated by the Nigerian SEC, we have gathered a list below.