Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

The stock market is home to thousands of stocks from dozens of industries. Choosing the right ones to trade or invest in can be challenging even for seasoned professionals. This creates the demand for various metrics by which to compare stocks and choose the ones that fit the expectations of the investor.

If you’ve ever traded stocks you may have heard the abbreviation ‘EPS’ before. EPS stands for earnings per share and is one of the most popular tools used in stock valuation. Often, reports from quarterly or annual earnings will highlight the discrepancies between forecasted and actual earnings per share, which has a major impact on the price of the stock once the news hits the market.

For dividend investors, EPS might be an even more direct indicator of how much dividends to expect over the long term, as a consistent decline in the company’s earnings could mean a discontinuation of quarterly dividend payouts.

If you are curious about how the EPS metric can be used in the stock market, this Investfox guide is for you.

As already mentioned, EPS stands for ‘Earnings Per Share’, which means that the metric is derived from two crucial points in the financial statements of the issuing company - earnings, and number of shares.

Thus, The formula for calculating EPS is:

EPS = (Net Earnings / Number of Outstanding Shares).

To further break down the formula:

EPS is an important metric as it shows how much profit a company generates for each of its outstanding shares. Investors use EPS to evaluate a company's financial health, profitability trends, and to make comparisons with other companies in the same industry or sector.

Higher EPS generally indicates greater profitability on a per-share basis, which can be a positive sign for investors.

However, it is important to consider that the EPS figure alone is not a reliable indicator of a company’s growth prospects over the long run, as many short-term operational issues can impact the profitability of a company down the line.

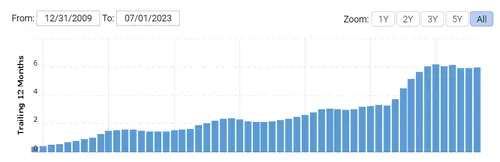

Apple’s (APPL) EPS growth over the years.

In general, EPS is not the first metric stock traders look at when picking which stock to buy. While a company may be profitable and their per-share earnings might look impressive, many other factors can interfere with the earnings growth of a company and shift the EPS into a negative value - signaling net losses.

However, this does not mean that the EPS is a negligible metric in stock trading, Here are a handful of applications for EPS:

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

In stock trading, EPS refers to earnings per share, or the amount of profit generated by a company for a single share of its stock.

The EPS has many applications. Traders can use the metric to compare stocks, make investment decisions, evaluate profitability and estimate future dividends. However, the EPS figure alone is not a viable tool to base entire investment decisions on.

Yes. A stock’s EPS figure can be negative if the company’s latest income statement shows a net loss, which is then divided by the total number of outstanding shares.