Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Stock trading and investing can be a highly complex process that involves hours of research to pick the right stocks for your investment objectives.

Fundamental analysis is the process of analyzing the factors directly related to the performance of the underlying company, such as financial results, governance, long-term strategy, etc.

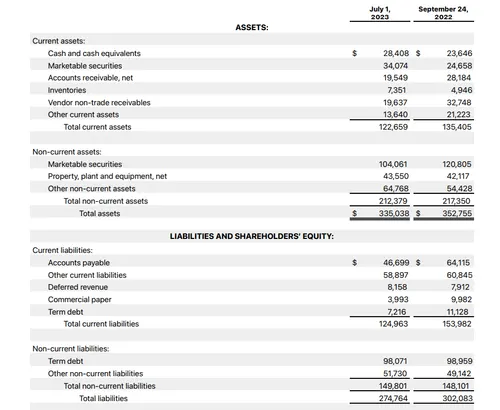

One important fundamental factor to consider is the balance sheet, which shows the number of total assets, liabilities, and equity attributable to the company.

Debt is arguably the most noteworthy type of liability a business can have, which also affects the stock performance.

When a company is heavily burdened with debt, investors may be less inclined to buy its shares, as debt accrues interest that must be paid regularly by the company.

Investors and analysts use various debt ratios to assess the financial health of the balance sheet of a business to decide whether investing carries outsized risks.

If you are a beginner trader and would like to know more about what a debt ratio is, this Investfox guide is for you.

Debt ratios are crucial metrics in stock analysis as they provide insights into a company's financial leverage and its ability to meet its debt obligations.

Depending on the other variable in the ratio, debt ratios can give great insight into how well the company can manage its debt obligations and if not, where the major issues may lie.

Here are some commonly used debt ratios used in stock analysis:

Most debt ratios have quite straightforward formulas that are easy to calculate. Here are the formulas for the aforementioned debt ratios:

Debt to Equity Ratio = Total Debt/Total Equity

Interest Coverage Ratio = EBIT/Interest Expense

Debt Ratio = Total Debt/Total Assets

Debt to Capitalization Ratio = Total Debt/(Total Debt + Total Equity)

Current Ratio = Current Assets/Current Liabilities

Quick Ratio = (Current Assets - Inventory)/Current Liabilities

Using these debt ratios, investors can assess the ability of a company to pay off its debts. If the ratios show high values, this may mean that the company is overburdened with debt, which could cause difficulties in the long term.

To better understand how debt ratios work in practice, we can calculate the debt ratio of Apple Inc to see how well the company can manage its debt load.

According to the 2022 full year financial report, Apple has a total debt figure of $111,88 billion and assets over $352,58 billion.

The debt to asset ratio adds up to 0.317, which means that almost a third of Apple’s assets are derived from debt.

Such a ratio may be problematic for most other companies, but since Apple is a consistently profitable corporation with global reach, the debt ratio is of less concern to its long-term shareholders.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Debt ratios, such as debt-to-equity, debt ratio, and interest coverage, reveal a company's financial leverage, debt management, and ability to meet obligations. They help investors assess risk, financial health, and the company's reliance on debt for financing.

Yes, debt ratios are crucial in stock trading. They provide insights into a company's financial health, risk, and ability to meet obligations. Traders use these ratios to assess investment risks, make informed decisions, and manage portfolios effectively.

A high debt ratio can be concerning, as it indicates higher financial leverage and increased risk. While some level of debt is common, excessively high debt ratios may lead to financial instability, higher interest expenses, and challenges in meeting debt obligations.