Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

You might remember the recent frenzy of meme stocks that transpired on the stock market in 2020-2021. The shares of retail companies, such as GameStop, AMC, and Bed Bath & Beyond went through the roof - causing hedge funds to panic and retail investors to push back hard against institutional short positions, causing a major short squeeze on the stocks.

While this was certainly a historical event for the global investment community, it was by no means the first short squeeze to ever happen.

You might be surprised to learn that Volkswagen (VW), which is one of the largest and most well-known automakers in the world, became the center of a major short squeeze in the midst of the Great Financial Crisis of 2008.

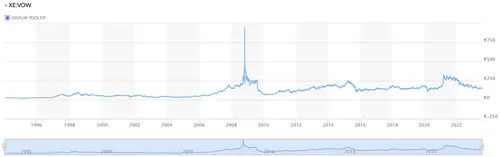

On October 28, 2008, Volkswagen’s share price skyrocketed to its all-time high of EUR 1,005 - briefly making it the most valuable company in the world.

What’s more fascinating is the fact that the participants in the 2021 short squeeze attempted to squeeze VW stock once more, and it worked - for a brief period of time.

If you would like to know more about the crazy mechanics of a short squeeze and revisit one of the most legendary squeezes of stock market history - you’ve come to the right place.

To understand how short squeezes happen and why the price of a stock can skyrocket in such a short period of time, we must first understand the mechanics of short-selling - what it is, how it is used, and how it plays into the seemingly anomalous jumps in the price of a stock.

Short-selling refers to a trading strategy that includes traders/investors borrowing shares from a stockbroker and selling them immediately with the intention of buying them back at a later date.

The prime objective of short-selling is to profit from the decline in a stock’s price.

If the price actually goes down, the short-seller can then buy back the stock at a lower price, return them to the broker, and pocket the difference as their profit, minus any transaction costs and other fees.

Short-selling is especially popular among major institutional investors. When investors deem a stock to be overvalued at its current price, they will short it until it falls down to a price they deem more reasonable. However, short-selling also has an unlimited downside, as there is simply no theoretical limit for how high a stock’s price could go. This particular trait is the backbone of all short squeezes, which we will discuss in the following section.

When a heavily shorted stock comes under sudden buying action, the investors who have shorted the stock end up in a disadvantageous position, as they were expecting the price to keep dropping. The longer the price of the stock remains higher than the price desired by short-sellers, the closer their margin call gets, at which point they will either have to liquidate their positions, repay the broker and take the losses head on, or double down and throw more money into the trade. Either way, things can spiral out of control really fast, especially if the stock being shorted has a lower trading volume and market capitalization.

For a short squeeze to go into full effect, this is the general process that needs to be followed:

The Volkswagen short-squeeze was a unique occurrence on the market at the time. In the midst of the Great Financial Crisis of 2008, Volkswagen saw its shares skyrocket, reaching above EUR 1,000 and briefly becoming the most valuable company on the planet.

Here’s what lead to the short squeeze and how the ordeal unfolded on the market in 2008:

After the 2008 crash, the stock market gradually regained its footing, which translated into one of the longest bull runs in history. This run culminated in the stock market frenzy of the pandemic years of 2020 and 2021, which also saw historic short squeezes on heavily shorted retail stocks, such as GME, AMC, and BBBY, among others.

While the bulk of the market was focused on a handful of retail stocks, rogue traders saw an opportunity to repeat the 2008 feat on Volkswagen stock - and briefly succeeded.

Volkswagen’s shares reached just under $435 on April 16, 2021. This marked an 800% increase over the course of five days.

However, a correction quickly followed and Volkswagen’s stock started to stabilize between the $120-150 range.

Short squeezes are important market phenomena that help highlight the inherent risks associated with leveraged investments. Short positions, in particular, are very risky, as there are no theoretical upper limits to any given stock, which means that unsuccessful short positions can quickly spiral out of control and lead to considerably more losses than the initial investment.

Cases such as these help traders and investors understand the complexities of the stock market and put into perspective the sheer speed at which prices move sometimes.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

The Volkswagen short squeeze happened in October 2008, when Porsche unveiled a majority stake in the company, which saw short-sellers “running out” of Volkswagen stocks to buy to repay their brokers by margin calls. This, coupled with new buyers entering the market, caused Volkswagen’s stock to skyrocket to over EUR 1,000 - making it the most valuable company in the world at the time.

A short squeeze happens when a stock with high short interest increases in price, at which point short-sellers have to buy back their borrowed shares at higher and higher prices. If more buyers are entering the market, this further exacerbates the issue for short-sellers, who risk losing considerably more than their initial position values.

A key catalyst of the Volkswagen short squeeze was Porsche’s 74.1% stake in the company, which meant that short-sellers had a limited supply of VW stock available to buy back, which added more upside pressure and dramatically increased Volkswagen’s stock price.