Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Managing your finances can be easier said than done. The fast-paced lifestyles of millions of professionals leave little room for individually micromanaging costs, savings, net worth, and other important financial metrics. Luckily, there are plenty of personal finance solutions available on the market that can greatly simplify your finances while keeping all the variables contained on a single platform.

Intuit Mint (formerly Mint.com) is a free personal finance software with over 30 million users in the United States and Canada. Personal finance consists of many different aspects, such as bill payments, loans, interest payments, etc. Mint offers all of the necessary financial management services for individuals in one place and users can sign up for free.

"It's a kick-ass personal finance tool" - Aaron Patzer

Founded in 2006, Mint was acquired by Intuit in 2009 and has operated under the Intuit umbrella ever since. The platform offers budgeting, bill and subscription management, as well as credit score and investment tracking services to its customers. The Mint app currently maintains a score of 4.3/5 from over 200K reviews on Google Play and 4.8/5 from over 760K ratings on the Apple Store.

If you would like to know more about the features as well as the pros and cons of using Mint for your personal finances - this Investfox review is for you.

Mint is a personal finance platform owned and operated by Intuit, which offers various budgeting and financial planning tools for individuals. Some of the services available on Mint include:

These are some of the services offered by Mint, which has amassed over 30 million active customers in the United States and Canada. The software is available for free and offers a web platform as well as a mobile app for iOS and Android devices.

Mint has won numerous awards over the years and continues to integrate new solutions into its platform, such as the Mint Salary service, the Beta version of which has already been launched.

Mint boasts a wide variety of features, including budgeting, bill tracking, payment alerts, etc.

Some of the most convenient and widely used features include:

The selection of Mint’s services is quite wide. Budgeting, investment management, and tax reporting are some of the most frequently used Mint services. Aside from this, Mint also has targeted advertising from partner financial institutions. As Mint has access to your financial information, they allow partners to offer you better rates and increased savings, while keeping Mint free to use for everyone.

"I started Mint because I was frustrated with all the existing tools that were out there" - Aaron Patzer

Mint’s budgeting solution allows users to set monthly budgets for specific needs, based on their spending habits and income. For example, a user can set a spending threshold for utilities and Mint will use that threshold to notify the user whenever they are over their limit. This also includes monthly comparison charts to analyze spending habits and identify areas where costs need to be or can be cut.

Users will receive recommendations for key areas where costs can be cut, as well as advertisements for services at discounted prices. The number of categories users can create is limitless, which allows for a wide range of custom budget sections. Mint also notifies users when they are close to crossing their spending limits on any of the predefined categories.

Another important service offered by Mint is investment tracking, which allows Mint to track and analyze ongoing investments made by the user and their performance. This allows users to keep track of their passive investments and retirement savings in real-time. However, Mint only allows users to view their investment performance - making investment tracking the least interactive service offered by Mint. Users expecting a complex investment dashboard may be a bit disappointed. However, investment tracking still does what it intends to do - it shows the changing value of users’ investments, which is vital in budgeting and measuring net worth.

The investment tracker shows the best and worst performers within the client’s portfolio, who can view the charts of stocks and indexes from a time frame as low as 5 days and as high as a year.

Being a part of Intuit, Mint grants access to TurboTax, which analyzes and calculates taxes on behalf of clients. This includes filing Federal taxes for free. Using Mint’s services also reduces overall tax time for users in a few key ways:

Mint is often recommended by tax professionals to non-finance-savvy clients who wish to file their tax returns with minimal hassle. Mint allows users to categorize their investment gains and losses and does so in a clear, clutter-free manner.

As already mentioned above, what sets Mint apart from the competition is the fact that the service is free and well-integrated into the full suite of Intuit services. Mint allows users to use TurboTax to significantly reduce the time it takes to calculate taxes based on their income, expenses, investments, etc.

Users can easily export data into Excel or Google Sheets to present them to a tax professional, or to get a clearer picture for themselves. Users can also get their tax reports from Mint via email, which can be an added convenience during tax season.

Aside from tax reporting, Mint is also quite user-friendly and free from the usual clutter of too many complex features, which is common with personal finance platforms.

While Mint may be a great dashboard for overviewing your finances from different sources, it does not function as an investment platform. Users can link their investment accounts to Mint, but this only allows them to review the performance of their investments. However, this might not come as a surprise to many users, as Mint is free and does not hold a brokerage license, which disqualifies it from allowing clients to interact with their investments.

Some users may also be put off by a large number of targeted advertisements on Mint, which represents the primary source of income for the platform and allows it to remain free. These targeted ads also offer services from partner institutions at competitive prices, which may prompt some users to switch over from using Mint.

Mint is part of Intuit, which is a public company listed on the Nasdaq, and users of Mint can be confident in the safety of their accounts and information. Another factor that can add to the security of users is that they do not deposit any funds to Mint and only allow access to data from their existing accounts, which are secured by the institutions that hold the funds on their books.

In terms of data security, Mint is an encrypted service, which adds a layer of protection for users.

To ensure that Mint is in a stable financial condition and to get additional information about the platform’s yearly performance, clients can review the quarterly reports posted by Intuit and find the performance data of the Mint segment there.

While Mint is primarily a free-to-use service, it still features paid tiers. Users who find the ads distracting can switch to an ad-free tier, which costs $0.99/month. The $4.99/month tier gives users access to additional features, such as:

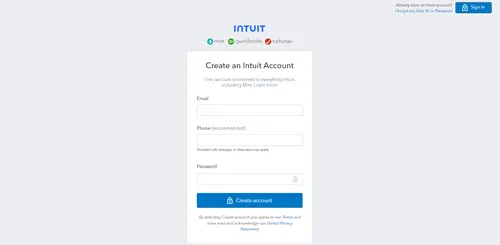

Signing up for Mint is a fairly straightforward process, depending on the preferred platform of the user. Mint will require a user ID and password, as well as your primary phone number. After that, users must input and verify their information such as identity, residential address, occupation, and prior experience with Intuit (if applicable). After that, clients can start adding their existing accounts to Mint, which will analyze the information and present it on its cash flow dashboard. Users can view their financial performance on a periodic basis and can start applying the aforementioned features available to Mint clients.

The registration process is the same for the Mint app. After downloading the app, users can log into their accounts and view their finances from anywhere, at any time.

Mint is a free-to-use personal finance platform offered by Intuit. The platform is integrated into the full suite of Intuit products, which allows Mint users to gain access to other Intuit services, such as TurboTax.

Mint’s interface and features are intuitive and easy to use. Clients can integrate existing accounts into Mint to get a detailed view of their income, expenses, ongoing liabilities, and cash flow, among other data.

While Mint is free, it does offer premium tiers as well, which use no advertisements and come with a host of convenient new features.

Mint sets itself apart from competitors by offering tax reporting services and a rapid export of its data as CSV files.

While some clients may find the constant barrage of ads a bit inconvenient, Mint more than makes up for it with an affordable premium account and a breadth of useful features that can aid clients of all experience levels.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Yes, Mint is a secure personal finance tool that handles users’ data with care and uses their account information to create dashboards for its users. The security of users’ accounts is not compromised by using Mint’s services.

Mint is primarily a free-to-use service provided by Intuit. However, users who would like to use the platform without ads and/or additional features, have the option of using the $0.99/month ad-free subscription or can pay $4.99/month for Mint Premium accounts.

Users who are extra conscious of their digital footprint may be somewhat put off by the number of targeted ads on their Mint accounts. However, Mint uses these ads to target users with competitive offerings, which can be offset by switching to the $0.99/month ad-free account.