Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

The currency strength meter indicator gives the trader an idea about the potential direction of selected currencies. This estimation helps the trader land a successful trading position in the Forex market.

This indicator is used by traders before opening any market position in the currencies market so that they do not indulge in currencies that are not profitable, or waste their money in losing market position.

Hence, we are going to showcase how this meter can be used, how to add it to the trading platforms, and what the benefits are of using it.

The currency strength meter is an indicator that shows how strong or weak a currency is in comparison to other currencies that are traded in the Forex market.

Some traders consider the Forex currency strength meter a crucial indicator when trading in currencies, as it provides the Forex trader with a broader insight into the value of the currency. That helps them make trading decisions before opening a market position on any currency pair.

It can be added easily to most trading platforms, and although currency strength meters all function in a similar way, they tend to look different. It is up to every trader to choose the one that works best for them and to make sure they can read the strength meter correctly.

“Short-term volatility is greatest at turning points and diminishes as a trend becomes established.” - George Soros

Once added to the trading platform, the currency meter algorithm works by analyzing the activities of a certain currency over the last 24 hours, and comparing the results against every other currency it is associated with.

Given the huge amount of currency pairs in the Forex market, it might become confusing for the trader to make the right decision. When a trader sees that a currency is stronger than another, it is estimated to be a winning market position.

The Forex strength meter will provide some insight to the trader regarding the best pair combination in the market that offers the best profitability, and what currency pairs correlate with each other.

This indicator analyzes the last 24 hours’ activity in the currency market and provides a visual representation of the best-performing currencies, called strong currencies. In comparison, the less well-performing ones are marked as weak currencies.

Reading the currency strength meter works as follows.

Looking at the image above, the reading indicates that the USD and the JPY are strong currencies, while the AUD is performing weakly. Based on the above indication, it is recommended to trade in favor of the USD or the JPY against the AUD.

However, this estimation is built on the prediction of the past 24 hours only. There is a possibility that a strong currency might change direction due to some news, and start a downtrend.

Since Forex traders rely on the volatility and the price difference between currencies to make money in the Forex market, a currency strength meter-based trading system helps the trader understand which currency pairs have enough potential to be worth trading.

Volatility in this indicator can be read from the strength difference between currencies. If a currency is strong and another currency is very weak, it means that this pair is volatile, and therefore it could be a good chance for the trader to make profits.

However, if two currencies are almost similarly strong or similarly weak, there is a possibility that this pair is going to move in the same direction, and therefore, the volatility is low and does not really present a good investing opportunity.

Currency strength indicators can be used on any trading platform, and this includes MetaTrader.

A free currency strength meter is available to download on MetaQuotes by following these steps:

Traders can use the free version of the currency strength meter on MT4, however, if a trader wants to use more advanced features, there are paid versions available as well.

There are different shapes and forms of currency strength indicators. They can be represented either by linear charts, tables, or figures.

This type of currency strength indicator reads the relation between two currencies and measures the performance of the base currency against the quote currency.

In the above example, the chart shows the performance of all other currencies in relation to each other, which, for example, depicts a better performance for the GBP than the USD.

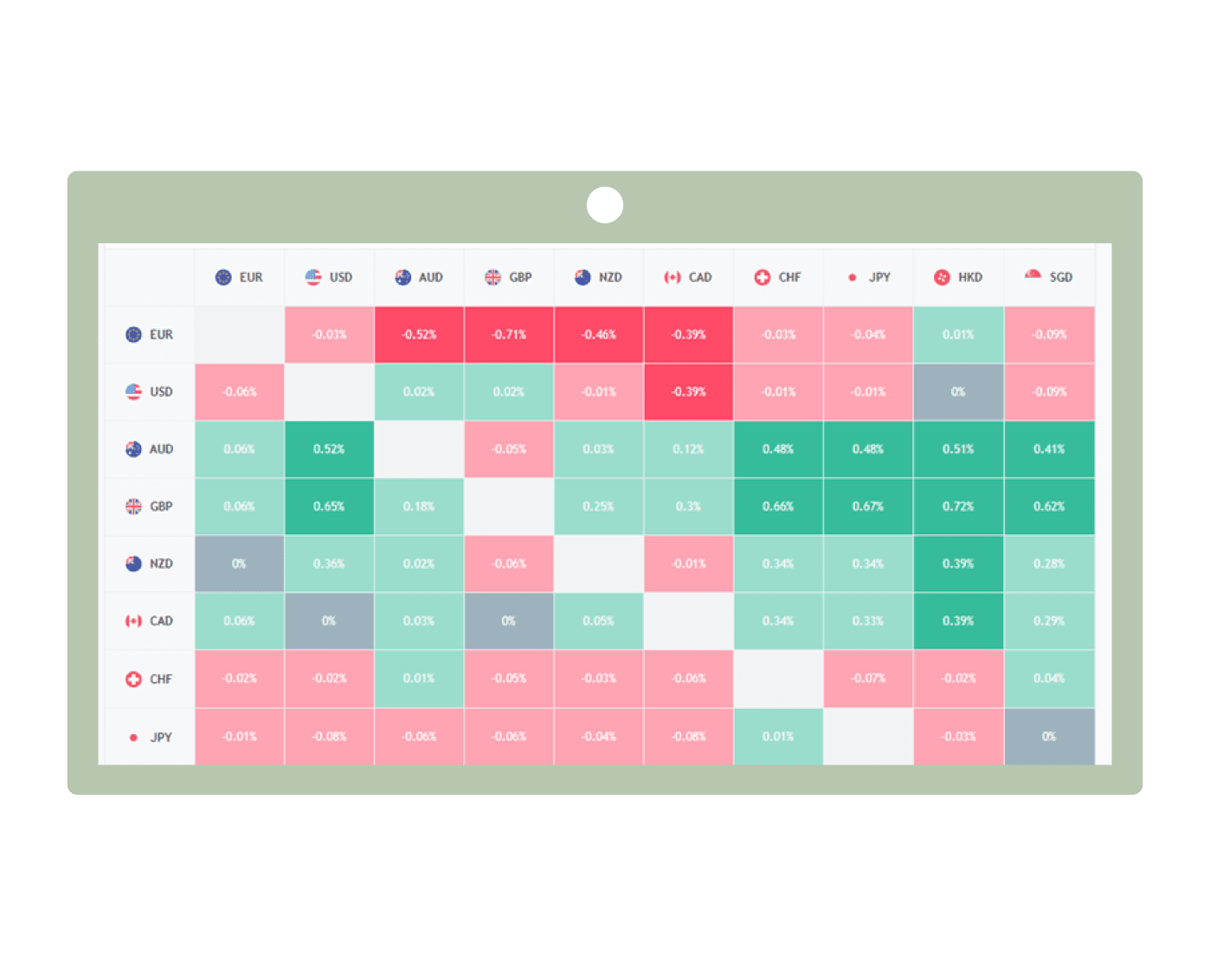

The other type of currency strength indicator in MT4 is called the Matrix. This indicator gives a snap view of the major currencies with a comparison against each other, which shows which currency pair is expected to be more profitable.

This strength meter type takes into consideration the possibility of having contradictory market positions in the currency market when an investor trades using more than one currency pair.

When a trader chooses to open multiple market positions for two currency pairs, there is a possibility that when one currency pair increases in value, another currency pair will decrease.

This currency strength meter helps the trader overcome this challenge by giving insights based on the historical performance of different currencies.

It might seem confusing if a trader does not know how to read the currency strength meter but it is quite simple. The colors represent the following:

As good as the currency strength meter sounds, there is some stuff a trader needs to take into consideration while using this indicator. Here are the major pros and cons of the MT4 currency strength meter:

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Major currencies such as USD, EUR, GBP, and JPY can be found on most currency strength meters. At the same time, some meters also incorporate less commonly used currencies such as CHF, AUD, and CAD.

While some meters also feature exotic currencies such as SGD, NOK, and PLN. However, the possible flaw here is that the meter can be less accurate than with major currencies.

Yes, it can be added in almost the same way the currency strength meter in MT4 is added. Once you download the currency strength meter and place it in the same file location of the MT5 folder it should be added to your list of available indicators.

Find the indicator in the navigation panel on MT5, then add it and start using it on your preferred market.

It is not a 100% accurate indicator. However, the accuracy varies depending on the currency pair or pairs being traded.

It can be highly accurate when a trader evaluates the major currencies’ strength because these currencies are used by the vast majority of traders, trading software, markets, and brokers.

While the less used currencies can be less accurate, especially if they are not the highlight of the Forex market, relying on the currency strength meter, in this case, can become risky.