Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Have you ever wanted to swap one of your cryptocurrencies for another and found out that the exchange you have been using does not support direct swapping between these cryptos? So what options do you have?

Most people would take a route where they trade the cryptocurrency they own to a third one e.g. USDT and then use this to purchase the crypto they want. This usually racks up huge fees, especially if there are tokens involved which operate on the Ethereum network. Let us introduce Balancer, an automated market maker which makes trading ERC-20 tokens easier than it has ever been and also gives the opportunity for new investments. Let's take a deeper look at what it is exactly.

Balancer is a decentralized exchange, automated market maker, and liquidity pool protocol with around 17,500 liquidity providers. This platform is built on the Ethereum network and supports ERC-20 tokens. But there are also possibilities for using other tokens by bridging them. The most famous example of this is Wrapped Bitcoin. Being a decentralized exchange, Balancer is not run by any single entity and everything is done using smart contracts. This approach to operating an exchange follows the whole concept of cryptocurrencies and their decentralized nature.

Balancer is also an automated market maker, which means that there are no order books. Everything is done through smart contracts and liquidity pools to calculate the price of cryptos.

“A lot of people think the Balancer is just a flexible AMM,

it's not, it's a lot more than that. It's a platform for AMMs to be built on top of” - Fernando Martinelli

Lastly, Balancer is a liquidity pool protocol. What this means is that Balancer has a liquidity pool that can be used to invest in or trade cryptocurrencies one for another.

Balancer is an exchange that supports crypto selling and buying. There are no set fees, and they are easily customizable by liquidity pool creators. You can expect to pay trading fees from 0.0001% to 10%, and they are chosen by pool creators. These fees are then proportionally distributed between liquidity providers based on how much liquidity they provided.

Anyone can provide liquidity for Balancer and earn rewards for doing so. These are done by a 1:1 ratio or however you wish to set it up, which means that if you are providing liquidity, let us say Ethereum and USDC, you have to provide a number of tokens that are of the same worth. So if you are providing liquidity of $1000 Ether you have to also provide $1000 worth of USDC. Here you have two options. Either join an already existing pool or create your own liquidity pool if there is not already one for that token pair. But keep in mind that when creating your own pool, you will need a huge amount of capital in order to keep the pool running. When doing so, you will be able to set trading fees that traders will have to pay when using your pool.

If you wish to start using Balancer, you will need to decide which of the Balancer features you will be using. Are you going to use Balancer for trading, or will you be providing liquidity to earn rewards? Once you decide, we will tell you how you can start.

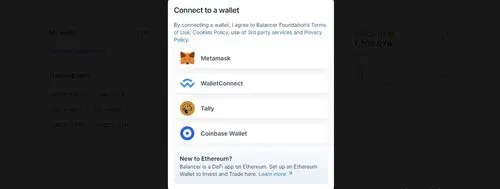

When you are starting on Balancer, you will need an Ethereum crypto wallet to connect to the exchange. This is a must for both traders and liquidity providers. Balancer currently supports 4 wallets. Metamask, WalletConnect, Tally, and Coinbase Wallet. So choose one of these wallets if you don’t already have one. Technically these wallets operate in the same way with minimal differences, but our suggestion is to use Metamask, as this is the biggest Ethereum wallet available.

Another thing that both traders and liquidity providers will need to do is to connect their crypto wallets to Balancer. All 4 of these wallets are software wallets that come as browser extensions, so connecting them to the exchange should be easily done. When joining the Balancer App you will see Connect Wallet at the top right of the screen. There you will be given the option to choose which wallet you want to connect to and then simply connect it by following the popup menu of the wallet.

Another thing we need to do before using Balancer features is to choose which network we wish to use. Balancer has Ethereum, Polygon, and Arbitrum networks available for people to use. The one you choose should be determined by your goal and preferences. For example, if you wish to have fast crypto transfers you should choose the Polygon network.

If you are interested in Balancer's trading feature and wish to utilize the huge selection of crypto trading pairs, then simply select the Trade option on the main screen. Once there you will be given the simple interface where you can select which crypto you want to swap for which crypto and then simply confirm the swap. Here you will be given some important information in the form of a chart of the tokens you are swapping and some of the trending trading pairs.

If you wish to provide liquidity and invest in the platform, you will need to choose the Invest option which will be alongside the Trade option. There you will be given the list of liquidity pools you can join. There you will be given every bit of information you will need to know for providing liquidity. It will tell you how much liquidity is in this pool, the 24-hour trading volume, APR you will earn, etc.

If you don’t see the trading pair you wish to provide liquidity for, you can create your own pool by going to the Create Pool section. There you will need to select which tokens you want to provide liquidity for and the weight of each token. Then you will need to select the fee you wish traders to pay when using your pool. Simply set the initial liquidity and confirm the pool creation.

Well, you earn rewards for providing liquidity, but in what form are you receiving these rewards? Balancer has its own native token called BAL, which at the time of the writing of this guide is worth $6 and has a market capitalization of $225 million. This is what you receive when providing liquidity and there are multiple ways you can use this token.

You can use BAL to trade on Balancer and use it just like a normal token. But since Balancer is a DeFi protocol, BAL tokens hold governance rights and holders receive voting rights. These votes can be about everything related to the Balancer and each vote will hold weight based on the number of tokens you have.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

The major difference between Balancer and Uniswap is that Uniswap only supports liquidity pools of 2 assets, while Balancer has liquidity pools that can go up to 8 assets.

Balancer's native token, BAL, can be used for regular trading. You can also provide liquidity of BAL tokens to the exchange, but the most important utility of BAL tokens is the governance right. Everyone who holds BAL receives voting rights on the proposals made around the Balancer protocol.

There are no set fees on Balancer. When liquidity providers are creating liquidity pools, they can select the fees that traders must pay when using this pool. These fees can range from 0.0001% to 10%, and they can also be set to move according to the pool.