Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Trading Cryptocurrencies have seen an increase in interest over the last few years, as more people are trading in this market. The market is highly volatile and investors can make money by purchasing and holding an asset for the long term or through short-term trading.

One strategy for trading cryptocurrencies is called day trading, which is when you open orders at the start of the trading day and close them out at the end.

It may sound confusing how this market operates, and you might require a bit of knowledge of how cryptocurrencies are mined and traded.

In the following, we will explain how to make the most from day trading cryptos:

The most important characteristic of the cryptocurrency market is high volatility. The daily volatility of Bitcoin can exceed 3%, which is high compared to other financial instruments.

There are some record volatility statistics for the BTC price. On 12 March 2020 the price dropped by a harsh 40% in a single day, and the next year on 8-February, the price jumped almost 20% higher in a span of 24 hours. Thus, you can only imagine the massive losses and gains day traders experienced on those specific days. If a trader invested $10,000 that very day when the BTC dropped 40%, that trader would end up with $6,000 by the end of the same day.

However, another trader who invested $10,000 on the day when the BTC price jumped by 20% would have gained $2,000 in a single day.

The traders who focus on short-term gains consider day trading as a good crypto trading strategy and some of them invest large amounts of capital as they hope that volatility flips that capital into wealth.

When a trader opens a market position usually at the beginning of the trading day, then closes and sells the position by the end of the trading day, it is called day trading. This way, a trader does not keep the position rolling until the next day and receives whatever was gained or lost during that trading day.

There are a couple of reasons why day trading is preferable over trading in a longer timeframe. Firstly, it depends on the strategy and the aim of the trader, whether someone prefers short-term or long-term gains.

Financial instruments that are not volatile usually go better with trading over a longer period of time, because most of the stock prices don't move enough in one day to make good profits.

On the other hand, volatile markets such as cryptocurrencies can be a good pickup for day traders. The price of cryptos fluctuates more than 3% on a daily average, yielding enough price change for profits to be realized in one day.

Trading cryptocurrency can be done in two ways. One may acquire a cryptocurrency such as Ethereum, and keep it in a crypto-wallet using a crypto exchange website, or a trader can trade on the speculation of a price change of the cryptocurrency, or what is known as the CFD, without acquiring the real cryptocurrency.

Whatever the way you choose to do your crypto trading, the following steps will show you how to start day trading cryptos.

The more you educate yourself about the cryptocurrency market, the better you become at day trading cryptocurrencies, since this market is relatively new compared to other markets. Besides knowing what cryptocurrencies are and how they were created, it is also important to understand how they work, what factors affect the price fluctuations, and what is the blockchain.

There is a huge number of cryptocurrencies on the market. By August 2022, more than 18,000 cryptos are recorded, and the number is increasing every day.

Cryptocurrencies differ in the way they are produced and used, some major cryptos are widely accepted as a method of payment, and some of them require a complicated mining process. This results in different pricing for these currencies. A trader may purchase crypto for $50,000 or spend less than $1 to buy another cryptocurrency.

Cryptocurrencies can get shaky after some news, and this fact makes cryptocurrency trading exciting for some. Any relevant global events or even a tweet can affect the price of some cryptos.

In June 2021, when Elon Musk, the CEO of Tesla, tweeted that the company will resume purchases using Bitcoin at some point in the future, the price of Bitcoin jumped by 12% and the value of Ethereum also jumped by 7%.

Depending on your trading strategy, or your aim, you may acquire a cryptocurrency through a crypto exchange website, or trade on the expectation that the price will increase or decrease.

When you acquire crypto through a crypto exchange, you can hold the currency for some period of time, and use the acquired cryptocurrency for online purchases wherever it is accepted. Or you can re-sell the cryptocurrency to the marketplace when the price increases, gaining the price difference or losing if you sell at a lower price.

On the other hand, if you do not want to acquire crypto, you may get hold of a broker to trade cryptos based on the anticipation that the price will either increase or decrease.

Cryptocurrency CFD trading is becoming more popular and more brokers such as Avatrade are giving their clients the opportunity to day trade cryptos besides other financial instruments.

Crypto exchanges or crypto wallet websites enable you to exchange your money for a chosen cryptocurrency which can be stored in an e-wallet. You may use this wallet for purchasing online, or to exchange it again with any other currency.

To open your crypto wallet, you need to find a crypto exchange website and register on it. While signing up, you will need to insert your personal information and get your account verified. After that, you will need to top up your account using one of the payment methods available on the website.

Usually, credit/debit cards are widely used and accepted, but if you prefer any other method, better check on the website before you register. Once you are sorted out, you can add funds to your account and exchange them for any cryptocurrency that is available on the exchange website.

Let’s say you exchange $4,000 for 1 Ethereum, you acquire this cryptocurrency in your crypto wallet. Now say that the price was fluctuating during the day and ended up going $150 higher than the original purchase price.

By the end of the day, when you exchange the Ethereum back for USD, the price difference is how much you can realistically make, and in this example, the $150 is your gain from this one-day exchange.

Then, you can either keep the amount that you gained in your crypto wallet, or you can withdraw that to your bank account. However, keep in mind to check on the website to know your withdrawal options and if there are any fees associated with them.

Alternatively, you can day trade cryptocurrencies without owning the cryptocurrency, and for that, you need to find and register with a broker that offers CFD trading.

There is a massive amount of financial brokers, however, you need to find a legitimate one. To do so check the license that they have, and what regulatory body observes the activity of the broker.

There are some licenses such as FCA, CySEC, and FSCA, which are considered top-tier regulatory licenses. These authorities impose some stringent regulations on the way brokers are allowed to behave, otherwise, hefty fines are imposed.

After that, you need to make sure that cryptocurrency trading is available on a selected broker's website, and check the offered spread, which is going to help you decide between the best brokers.

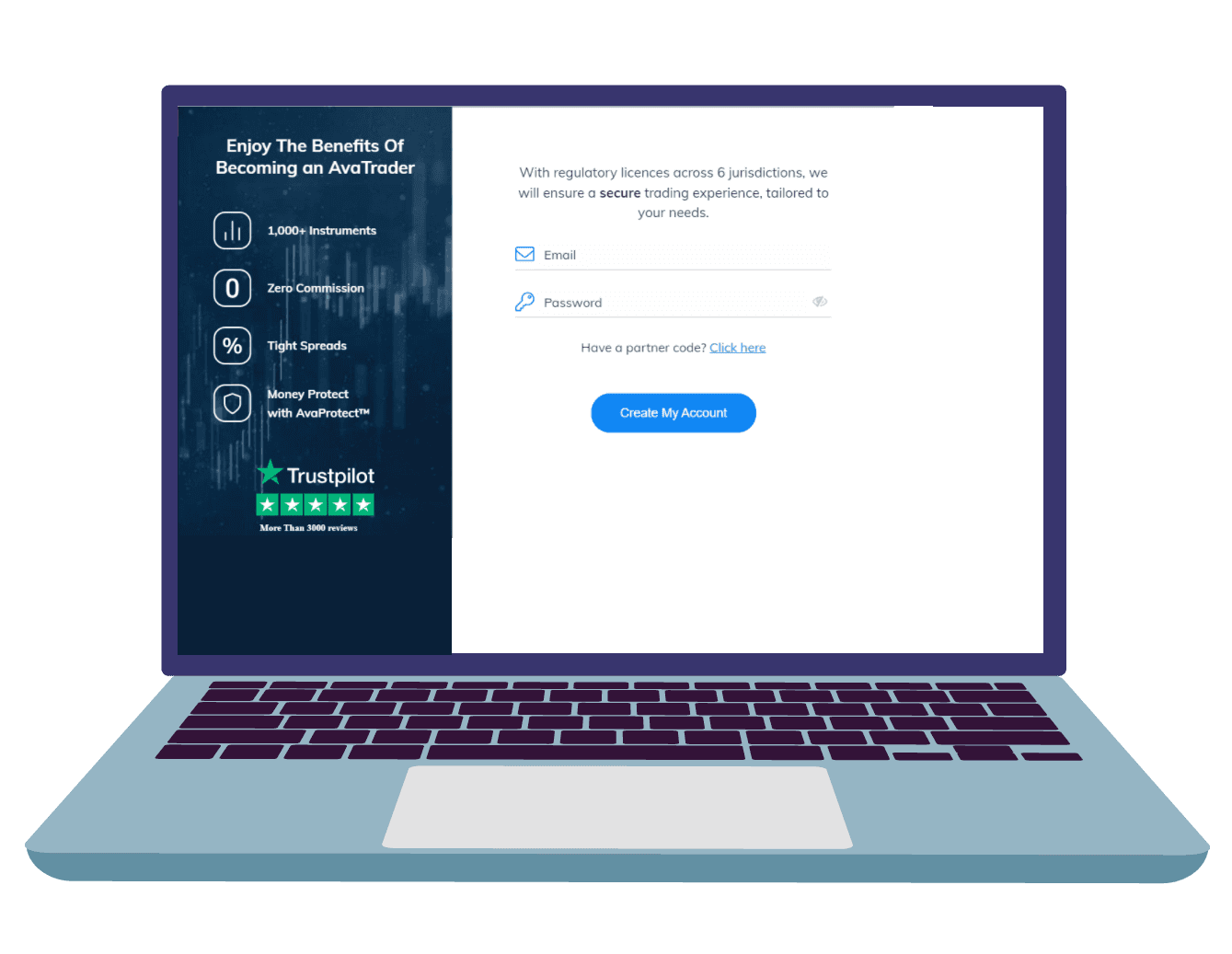

Once you have found where to trade cryptos, the sign-up process is simple. For example, to register with Avatrade, one of the most reliable brokers, you need to follow these steps:

Step one: Find the “Register Now” orange button in the top-right corner of the main page.

Step two: Enter your email address and create a password.

Step three: Fill out the form regarding your personal information, such as your name, address, country of residence, and contact number.

Step four: Verify your account by submitting proof of identity, and proof of address. This process is safe and there is nothing to worry about. It is done to ensure the safety of the platform.

After that, add funds to your trading account on the broker’s website, check the minimum deposit amount allowed, and how you can do that, under the payment methods.

Find the markets available on the broker’s website, and go to the cryptocurrencies market where you will start cryptocurrency day trading.

Using the trading platform offered by the broker, you can select the cryptocurrency that you want, and choose how much you will trade with according to your trading capital.

For example, if you have deposited $5,000 you can open a trading position on Ethereum. Alternatively, you can buy fractions of a Bitcoin or any other crypto that is priced more than your trading capital.

If you have decided to trade with 1 Ethereum, it means that you anticipate a price increase for the ETH. Let’s say under the previous example the price of Ethereum increased by $200 within a couple of hours. That means your trading position is winning, and your gain is $200. The price goes up and down and by the end of the day, the market closes at $150 above the price that you purchased.

As you are considering day trading cryptocurrencies, you are going to close your trading position by the end of the day, gaining the $150 extra to your capital.

Traders do not just randomly buy and sell assets, there is some strategy that they follow, based on which they can measure the success or the failure of their trading activity.

Trading strategies also differ if you are using a crypto exchange or a financial broker, and from the huge variety of trading strategies, we will look at the most common crypto day trading strategies.

The scalping strategy is a widely used method, and it can be used by beginners or experienced traders. It means buying and selling trading positions multiple times during a short period of time.

This strategy is used when you are day trading cryptos using a broker because you are entering the market at a certain entry price, and leaving the market at a certain closing price, reaping whatever price difference is there.

This strategy works very well in volatile markets such as the cryptocurrency market, where the prices move at a quicker pace. Scalpers gain from this activity if the price trend moves upwards, where they can achieve small gains over the day.

However, the high volatility makes this strategy risky as well because the prices might move downward very fast. If the first several trades were gainful, one last trade might see the trader lose everything they have achieved during that day.

This cryptocurrency day trading strategy involves buying and selling cryptocurrencies on different platforms, gaining different buy/sell prices at different crypto exchange websites.

To apply this strategy, you need to open several accounts in different crypto exchanges, where you are going to buy a cryptocurrency from one website’s marketplace, and sell it on another website where the price is different.

The reason this strategy can be fruitful is the fact that different platforms use different spreads, which results in different buy and sell rates.

With that, let’s say on marketplace A, you purchase one Ethereum for $4,000. You go to another marketplace B and you transfer the one Ethereum that you own there. let’s consider the selling price of Ethereum on marketplace B to be $4,020.

On marketplace B, you exchange that one Ethereum for cash and receive $4,020. In this way of crypto day trading, you gain $20 from one activity and when you repeat it multiple times, you can multiply the gains you receive.

An arbitrage strategy can be useful when trading cryptocurrencies that are less popular because they have wider price divergence, as major cryptocurrencies might only slightly differ between different marketplaces, and considering the transfer fees we might not make profits from these small differences.

This trading strategy is concerning day trading crypto CFDs with a broker. It relies on finding the right time to enter and leave the market in a way that a trader can maximize gains and minimize risks.

This day-trading cryptocurrency strategy is applied through the trading software offered by the broker. It uses the levels of resistance and support that show the limits for the price movement.

Once the resistance and support levels indicator is activated in the trading platform, a trader will see the minimum level expected for the price to drop, which signals a buying possibility.

At the same time, the indicator will show the maximum limit the asset price might reach, which is the price at which a trader may sell their crypto.

This trading strategy is used by day traders because it is easy to read and apply. However, since it is based on technical analysis, it only shows anticipated prices.

Therefore, it is possible for the price trend to cross the level of support or resistance, and that can cause traders to enter a losing trading position, or to miss more gains if the price keeps increasing until they have pulled out of the market.

There is a huge number of cryptocurrencies that you can choose to trade with, the first Bitcoin was the first crypto to be founded in 2009 with a value of almost zero.

Bitcoin has grown so much in value and by November 2021, it was valued at $69,000. Bitcoin is the most traded cryptocurrency of all time, and many crypto traders still trade it, either as a whole coin, or a fraction of it.

It is the most used cryptocurrency and can be traded and purchased at almost every trading platform or exchange, and the price difference between different websites can be little.

Other major cryptocurrencies used by crypto day traders such as Ethereum and Solana are almost traded the same way as Bitcoin in terms of availability and usage.

Other less-known cryptocurrencies such as XRP, Dogecoin, Polkadot, and BNB can also be traded for the same purpose. However, since they are less traded, their prices can be different across different platforms.

Major cryptos are usually more sensitive to changes as a result of global events and economic influences, while the less-known ones are not that sensitive to changes, and can only change as a result of increasing or decreasing demand.

Choosing the right cryptocurrency is totally up to the trader and to what is available on a selected marketplace. Some traders prefer highly dynamic cryptos which can offer some price jumps in the course of one day.

It is also important to note that other traders prefer sticking to the underdogs of cryptos, which provide little price changes and can be good to avoid extreme price declines.

Day trading cryptocurrencies seem appealing for many traders, specifically those who focus on the short-term gains made on the same day. However, that does not make it a perfect trading approach and there are several advantages and disadvantages to day trading cryptos.

It is debatable if it’s worth it to day-trade cryptos, or if you can make a living day trading crypto. To conclude what was discussed so far we can highlight the following points.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Yes, that is called day trading cryptos. It can be done with a financial broker that offers day trading in the cryptocurrency market, where you can open and close market positions using different cryptocurrencies. Or you can use crypto exchanges to acquire cryptocurrencies, then you can re-sell them on the same marketplace, or on different marketplaces that have a higher selling price.

It depends on your preference. If you prefer a fast-moving price such as Bitcoin and Ethereum, or the slow-paced movement offered by lesser-known currencies. Bitcoin is the most commonly used cryptocurrency by almost all traders, and it might be a good idea to start with it.

It depends on the trader’s goals. Those who prefer short-term gains might find it fruitful to start day trading cryptos where the high volatility offers a chance for gaining. While traders who do not have the time to keep their eyes on the trading chart for the whole day might prefer investing in the long-term, by owning cryptocurrencies and holding onto them for a long period of time.