Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Forex can sometimes be too overwhelming. No matter how many things you learn about, there are still hundreds of more concepts to get acquainted with. From tiny details like when you should place a trade to larger concepts like trading volume and indicators, it’s like a never-ending book. But no need to worry, even the best traders who trade Forex for a living don’t know everything about everything. They just know the key concepts, which is exactly what we will be talking about in this Forex trading for beginners guide.

When you are just getting started in the market, there are many things you should know and understand. Because there are so many details, it might be a bit hard to learn how to trade Forex if you are a beginner. Among the most important concepts in the market are Leverage, Spreads, Pips, and many others.

“Education is the key that unlocks the golden door to freedom.” — George Washington Carver

Let’s discuss these terms and understand how they work in greater detail below.

Leverage is one of the most important concepts in the Forex trading market to understand. When using leverage, you are essentially borrowing money from the broker in order to increase the value of your position. This is usually done to maximize prospective profits made in Forex.

The leverage ratios offered to traders vary from broker to broker. There are many things that it can depend on, including the local regulations in your country, your account type, and so on. While leverage is a very important tool that can maximize your profits, it is also associated with a lot of risks. Quite frankly, it can greatly increase the losses that you make. To avoid such scenarios, it is vital to use leverage with a lot of caution.

When learning how to start Forex trading for beginners, it is better to first avoid using higher leverage. In most cases, brokers offer leverage ratios between 1:50 and 1:100. But, this is not universal. Many regions around the world have some restrictions on the leverage brokers can offer. For example, in the EU, Forex traders can’t use leverage over 1:30.

A very important thing to remember about leverage is that it can act as a double-edged sword, meaning that as much as it can support your trading, it can also increase the risk of losing more.

Let’s say that you are trading EUR/USD with a leverage of 1:100 and your initial deposit is 1,000 dollars. This means that for the 1,000 dollars in your account, you will be able to open a position worth $100,000.

As much as it can increase your prospective profits, it can also drastically increase your losses. So, make sure to only use it when you are certain about your decisions.

Spread is another extremely essential concept to grasp, particularly when discussing the Forex basics for beginners. The spread is the difference between the selling and purchasing prices of currency pairs.

Spreads in Forex can be both fixed and floating. The first one, as the name suggests, does not change and always stays the same. As for the floating spreads, it can be different for every position you open, depending on the market conditions.

Let's say that you are a Forex trader from the US and you want to buy Euros. So, you open the trading platform and see that the bid-ask price is $1.1900/$1.1980. The spread, in this case, would be 80 pips (1.1980-1.1900).

The most popular type of spread is the bid and ask spread. In Forex, the bid is the buying price of a currency, and the ask is the selling price. The difference between the two is the spread.

When you look for guides on how to study Forex trading, you will notice that one of the terms that every trader should know is "pip". Pip stands for Percentage in Point, and it is the smallest price change of a currency pair. For the majority of the currency pairs, pip is the fourth number after the decimal point - 0.0001, and for the JPY pairs, it is the third number after the decimal point - 0.01.

There is even a smaller version of pip in Forex, called a pipette. It is 0.00001 for the majority of pairs, and 0.001 for JPY pairs.

Many Forex traders are using economic calendars to make sure that nothing goes unnoticed in the market. An economic calendar is a tool that lists all the important events that could have an impact on the price movements of currency pairs.

Using an economic calendar is especially important for news traders as well as others who focus on fundamental analysis. Among the most important events that you should keep an eye on are: GDP, CPI, NFP, as well as reports of Central Banks, and many others.

When discussing Forex basics for beginners, it should be noted that large events can have a huge impact on market volatility and price movements. This can create a lot of opportunities for winning positions.

When getting started in Forex, you will notice that Forex brokers offer different types of accounts. In most cases, FX accounts can be grouped into several categories:

Beginner accounts are great for learning Forex trading in a more sophisticated way. They offer you the opportunity to learn while trading, without having to risk a lot of money. This not only gives you factual knowledge about Forex but also helps you develop the skills necessary for becoming a successful trader.

The majority of brokers also offer accounts for intermediate traders, which are usually called Standard Accounts or something similar, depending on the broker. For the most experienced traders, many brokers have Professional or VIP accounts, which come with special benefits, such as lower spreads and higher leverage, for example.

If you are a trader with little to no experience in the market, the best thing to do is to use a demo account. This account can be a great help for those who want to learn how to trade Forex better. When you open a demo account, you are given a certain amount of virtual cash.

With this virtual money, you can open and close positions, test out different types of strategies, see how the trading platforms work, and grow as a trader in general. You do all of this for free, without risking any of your real-life funds.

In fact, many experienced traders frequently go back to demo accounts to test new ideas and see how they work in different market conditions. Once you run out of virtual cash, most brokers will provide you with more for further demo trading.

Many people believe that the right answer to the question, “How to learn Forex trading?”, is to simply start using a demo account. But, this is not true for every trader. As much as a demo account can be a great help for Forex traders, it is not the perfect choice for everyone.

The main reason for this is that demo accounts can’t teach you one very important thing - controlling your emotions while trading. Many traders end up losing large sums of their capital because they find it hard to control their emotions when dealing with real money. Because of this, it is always better to start slowly moving on to using regular trading accounts, rather than starting out with regular FX trading right away without first having practiced on a demo account.

But, how exactly do you start trading in Forex? Let’s discuss the steps you will have to take below.

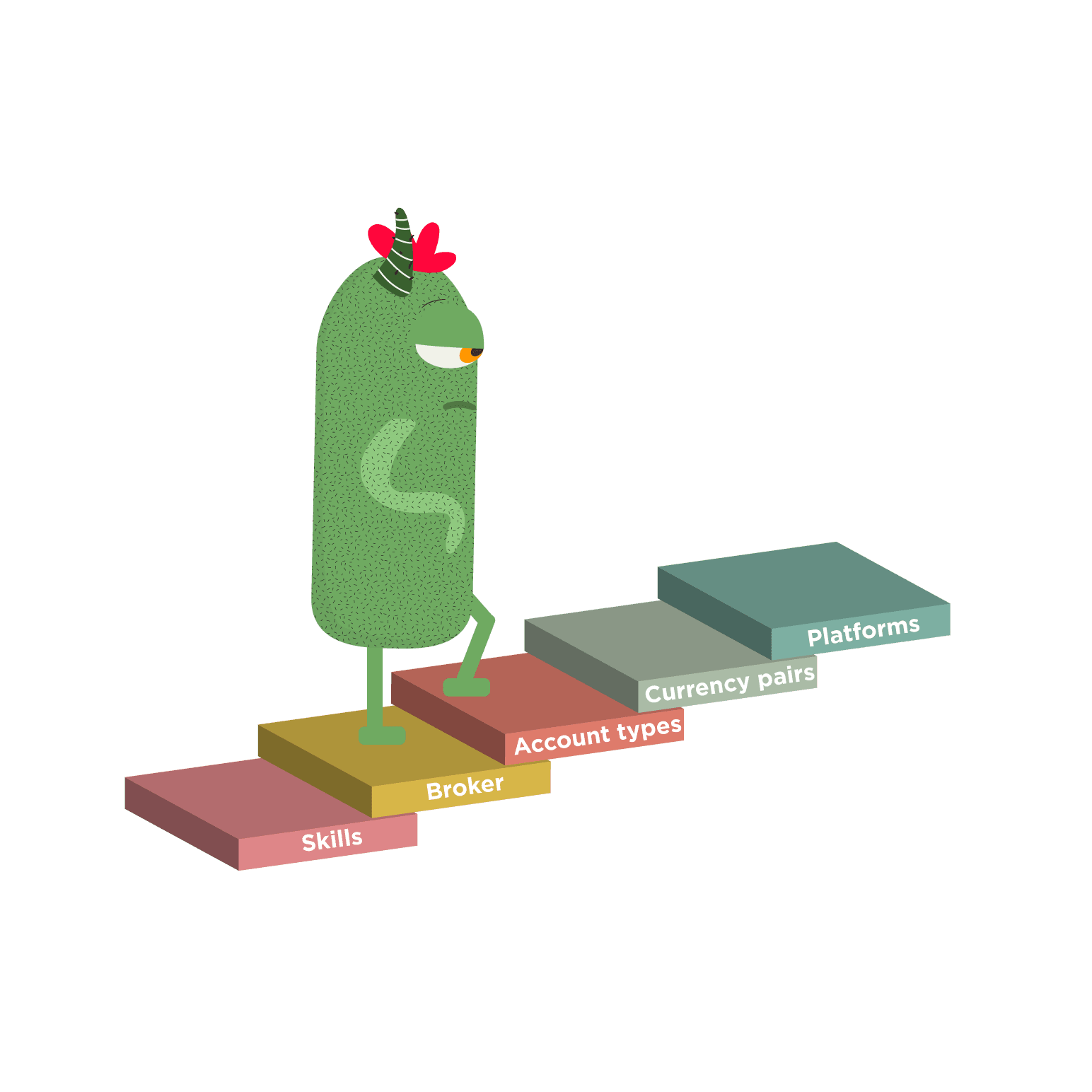

Becoming a successful Forex trader is not easy. But, there are certain things you can do to jump-start your Forex trading journey. Here are 7 easy steps for beginner Forex traders to follow:

In Forex, one thing that can determine your success is your knowledge and skills. Once you are confident in your skills and knowledge, you should continue by looking for a Forex broker. For this, you will be required to focus on several different factors. First of all, the broker you choose should be regulated and licensed by reputable financial regulatory agencies.

Then, check if all of your personal needs are covered by the broker. This includes the trading platforms offered by the broker and if they provide any trading assistance.

Once you are comfortable with your decisions, you can deposit funds into your account, open the trading platform, and start trading currency pairs.

When trying to learn how to trade Forex, it is very important to understand the different aspects of this market. For this, it is very important to understand the advantages and disadvantages of Forex trading.

By understanding the advantages and disadvantages of the Forex trading market, you will be able to tell if this market is a good fit for you. Below, we will start by discussing the major advantages of Forex trading, followed by discussing the downsides of this market.

There are many advantages to trading currency pairs. Among them is the volatility of the market, which creates a lot of trading opportunities, Forex market hours, and the fact that it is very easy to get started in this market.

Let’s now take a look at each of these, as well as other, advantages of Forex trading.

One of the biggest advantages of Forex trading is that it offers traders the opportunity to trade currency pairs at any time of the day or night. The Forex trading market is open 24 hours a day, 5 days a week.

This is possible thanks to the different time zones around the world. When one market closes, another one opens, which ensures that the market remains open 24 hours a day. A very interesting thing about the Forex market is that there is always some type of activity in the market, even on weekends, when the market is officially closed.

The reason for this is that there is always someone who wants to exchange currency pairs for personal reasons.

One of the most important things when discussing how to trade in Forex for beginners is understanding how the FX market hours work. Forex trading is not conducted at any one place. Rather, it is a global market, managed by various markets around the world. The market opens at 5 PM EST on Sunday and remains open until 4 PM EST on Friday. Any time in between, there is always at least one market open around the world.

In fact, sometimes, there are two markets open at the same time. In most cases, when such overlaps happen, the volatility of the market increases. This period is favored by many traders due to the many opportunities that can arise. Many even view it as the best time to trade currency pairs.

Forex trading is a very diverse market where things can change very quickly. Because of this, sometimes, the market can get very volatile. Volatility is something that many traders are afraid of, but, the truth is, it can be used by traders to increase their profits.

During volatile hours in the market, prices are changing very fast. This can be a bit dangerous for traders, but, if you manage to use it to your advantage, you might be able to use it for quick and easy returns.

Volatility can be especially useful for traders who are using short-term strategies. When you are learning how to trade Forex, you will see that there are many different strategies that you can use. One that is favored by many traders is scalping, which is a short-term trading strategy. It envisages opening and closing a lot of small-profit trades throughout the day. When the market is volatile, you can make better profits with your small positions.

A very important thing about Forex trading that makes it a great market to start trading in is the fact that it is easier to get started here than in other markets. All you have to do is find a Forex broker that you can trust with your funds, open a live account, deposit funds, and start trading. Simple as that.

However, the fact that it is easy to get started in the Forex trading market does not mean that it is easy to make profits. In fact, many people who start trading currency pairs end up losing their funds very fast because they simply do not have enough skills and knowledge. So, make sure to learn everything about the market before you decide to start trading Forex.

While Forex trading has numerous advantages, you should not forget that there are some drawbacks as well. First of all, the biggest disadvantage is that it is quite a risky market for trading. Because it requires a lot of dedication and analysis from traders, it can get quite difficult to trade Forex successfully.

Some of the biggest disadvantages in Forex trading are:

One of the biggest disadvantages of the Forex trading market is the risks that come with it. Although the fact that Forex offers higher leverage is mostly seen as an advantage by many traders around the world, it can also work against you.

Leverage acts like a double-edged sword in the Forex trading market, and it can be very dangerous for beginner traders to use leverage without adequate training and skills. Leverage can increase your chances of having higher losses, which makes it very important to use this tool with a lot of care.

In the Forex trading market, you are most likely to have to learn everything on your own. Although there are plenty of courses that you can sign up for, many traders prefer to learn on their own. This can be quite time-consuming and hard for beginner traders to do.

To be able to trade currency pairs successfully, you will also be required to do extensive market research and analysis. This includes both technical and fundamental analysis. Technical analysis is a process of using technical indicators and Forex charts to analyze the market. This can take you a lot of time and for many, it is considered to be a huge disadvantage.

Forex for beginners can be quite a confusing trading market, due to this they tend to make a lot of mistakes while trading currency pairs. One of the biggest mistakes that a huge majority of traders make is that they think they know everything and start trading with their actual money too quickly.

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.” - Peter Lynch

Without proper knowledge and a set of skills to back you up, it is almost guaranteed that you are going to lose your money. To avoid such scenarios, you should make sure that you have enough knowledge of the market before you start trading.

Also, while learning how to trade Forex as a beginner, many traders disregard the information about using technical and fundamental analysis in the market. If you do so, you won’t be able to understand all the different sides of the market, which can make it hard for you to trade properly.

One of the most common mistakes that many beginners make is that they are using very high leverage. It can be quite tempting to use high leverage when you want to make higher profits fast, but it is not something that you should do. Leverage can increase your losses quite a lot in the Forex trading market.

Our partner, XM, lets you access a free demo account to apply your knowledge.

No hidden costs, no tricks.

Yes, Forex trading can be profitable for beginner traders. As long as you do comprehensive research about the market, and understand how to do Forex trading properly, you should be able to make profits in the market.

To increase your profits in Forex, you can use leverage. Leverage is a very important thing used by many traders to increase the volume of their positions. As a result, the prospective profits increase a lot. But, keep in mind that this can also increase the risks associated with the Forex trading market.

The profits that you make in Forex will also depend on the strategy that you are using. Mostly, scalpers are able to make quick profits in the market, as they open several positions during the day.

Yes, you can absolutely teach yourself how to trade Forex. In fact, many traders in the market learn Forex trading step by step on their own. The internet is full of online forums where people gather to discuss everything happening in the Forex trading market, exchange ideas, and help each other understand the Forex trading market better.

You can even get a book about Forex trading, which can give you detailed information about everything that you should know. In addition, there are numerous online classes and courses that offer traders the opportunity to learn about the market from professional traders with years of experience in Forex trading.

Another option that you have is to start trading by watching guides on YouTube, which can help you even more.

You can start trading Forex with as little as a $100 initial deposit, or as high as $10,000. It all depends on your personal needs and final goals in the market. It also depends on the Forex broker you are using. Some brokers require traders to make at least a $250 initial deposit, while others will allow you to start trading with as little as $5. However, making such a little initial deposit is less likely to get you far in the market.

If you are just getting started with trading, making a $50-$100 initial deposit can be quite helpful to better understand the market and acquire enough skills to be able to trade with larger amounts later. But, if you are planning to make a fortune in the market, you should deposit more money.