Forex and CFD trading is becoming increasingly popular in the United Arab Emirates as both governments and businesses strive to turn the UAE into a global financial hub.

The Dubai Financial Services Authority (DFSA) supervises the conduct of financial activities in the UAE. The DFSA is an independent regulatory body responsible for enforcing anti-money laundering and counter-terrorist financing requirements. In addition, The DFSA’s regulatory mandate includes asset management, commodities futures trading, Islamic finance, insurance, etc.

As a resident of the UAE, you can open a live trading account with a DFSA-regulated broker, or find a globally regulated one. However, it’s recommended that you pick a broker that holds a license, as unregulated brokers are unsafe.

In this guide, we will explore the best FX brokers in the UAE, taking into account their regulatory compliance, account types, and trading fees on EUR/USD.

A quick comparison of top-rated Forex brokers in the UAE

When comparing top Forex brokers in the UAE, there are a number of things to consider. Ideally, you want a broker that enables you to open an account in AED. This way you can save a lot of money on conversions. Furthermore, low trading fees on USD/AED and EUR/USD are also super important.

XM

Read the review

Visit broker 8.4 8.34 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.03% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

Pepperstone

Read the review

Visit broker 8.2 7.75 Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

|

AvaTrade

Read the review

Visit broker 8.8 7.63 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

HFM

Read the review

Visit broker 7 5.86 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.77% of retail investor accounts lose money when trading CFDs with HF Markets (Europe) Ltd. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

|

HYCM

Read the review

Visit broker 8 7.97 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-76 % of retail investor accounts lose money when Trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. For more information please refer to HYCM’s Risk Disclosure. Additionally, the content of this website is for information purposes only and it is not intended as a recommendation or advice. Any indication of past performance or simulated past performance included in advertisements published by HYCM is not a reliable indicator of future results. The customer carries the sole responsibility for all the businesses or investments that are carried out at HYCM.

| |

| DFSA regulation | No | Yes | No | Yes | Yes |

| Operates in the UAE under | FSC | DFSA | ADGM | DFSA | DFSA |

| Account currency is available in AED | No | No | No | No | No |

| Spreads on USD/AED (commission–free Standard accounts*) | N/A | N/A | N/A | N/A | N/A |

| Spreads on EUR/USD (commission-free Standard accounts*) | From 1.6 pips | From 1 pip | From 0.9 pips | From 1.2 pips | From 1.2 pips |

| Maximum available leverage offered to UAE clients | 1000:1 | 30:1 | 30:1 | 30:1 | 500:1 |

| Minimum initial Deposit | 5 USD | 0 USD | 100 USD | 100 USD | 100 USD |

| Desktop Trading platforms | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, cTrader, TradingView | MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5 |

*Brokers usually offer 2 types of accounts, namely spread-free and commission-free accounts. With a spread-free account, traders are charged commissions on their trades, while with a commission-free account, fees are integrated into spreads. To make comparisons easier, we prioritize displaying prices of commission-free standard accounts where possible.

More about the 5 best FX brokers in the UAE

Below you will learn more about the account types offered by the brokers operating in the UAE. We’ll provide you with detailed information on the AED vs major currencies trading fees, and we’ll include the license number for each broker so that you can check the license documents yourself.

XM

XM is a group of Forex and CFD brokers regulated in various jurisdictions. Residents of the UAE receive financial services from XM Global Limited with their registered address being at Suite 404, The Matalon, Coney Drive, Belize City, Belize.

XM Global Limited is authorized and regulated by the Financial Services Commission (FSC) (license number 000261/309). Trading Point of Financial Instruments Limited is authorized and regulated by Cyprus Securities and Exchange Commission (CySEC) (license number 120/10), and both entities are members of Trading Point Group.

XM was founded in 2009 and quickly became popular among traders. XM provides financial services to over 5 million clients from more than 190 countries.

There are more than 1471 assets available for trading with XM, including:

- 57 Forex pairs

- 1261 shares as CFDs

- 100 physical shares

- 31 cryptocurrencies as CFDs

- 14 indices

- 8 commodities

XM offers 4 account types to UAE traders. 3 of these account types, namely the Micro account, Standard account, and XM Ultra Low account, are for trading Forex and CFDs. They also offer Share accounts which are solely for trading physical shares. Unfortunately, there are no AED currency pairs available for trading.

Visit broker

8.4

8.34

| Micro account | Standard account | XM Ultra Low Accounts | Shares account | |

|---|---|---|---|---|

| Spreads on EUR/USD | From 1 pip | From 1 pip | From 0.6 pips | As per the underlying exchange |

| Commissions | No | No | No | Yes |

| Minimum Deposit | 5 USD | 5 USD | 5 USD | 10,000 USD |

| Contract Size | 1 Lot = 1,000 currency units | 1 Lot = 100,000 currency units | Standard Ultra: 1 Lot = 100,000 currency units Micro Ultra: 1 Lot = 1,000 currency units | 1 share |

| Negative balance protection | Yes | Yes | Yes | Yes |

| Maximum open/pending orders per client | 300 Positions | 300 Positions | 300 Positions | 50 Positions |

| Minimum trade volume | 0.01 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots | Standard Ultra: 0.01 Lots. Micro Ultra: 0.1 Lots | 1 Lot |

| Islamic account version availability | Yes | Yes | Yes | Yes |

| Swaps | Yes | Yes | No | No |

| Hedging allowed | Yes | Yes | Yes | No |

Pepperstone

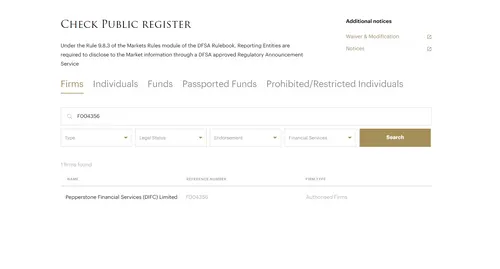

Pepperstone is a group of companies operating globally and regulated in 7 jurisdictions. Traders from the UAE receive financial services from Pepperstone Financial Services (DIFC) Limited.

Pepperstone Financial Services (DIFC) Limited is registered at Al Fattan Currency House, Tower 2, Level 15, Office 1502 A, P. O. Box 482087, DIFC, Dubai, United Arab Emirates, and is regulated by the DFSA under license number F004356.

Pepperstone was established in 2010 in Melbourne, Australia, and today serves more than 300 thousand clients worldwide. Pepperstone offers a wide range of trading platforms to its customers, including:

- a full set of MetaTrader platforms

- cTrader

- TradingView

There are more than 1200 assets available for trading with Pepperstone, including:

- 62 Forex pairs

- 1000+ shares as CFDs

- 23 cryptocurrencies as CFDs

- 23 indices

- 32 commodities

Unfortunately, there are no AED currency pairs available for trading. Pepperstone offers Razor and Standard account types to meet the needs of different traders.

Visit broker

8.2

7.75

| Razor account | Standard account | |

|---|---|---|

| Spreads on EUR/USD | From 0 pips | From 1 pip |

| Commissions | USD 3.50 (SGD 7 round turn) | No |

| Negative Balance Protection | Yes | Yes |

| Best for | Scalpers and algorithmic traders | New traders and position traders |

Avatrade

Avatrade is a global Forex and CFD broker regulated in 7 jurisdictions. Traders from the UAE receive financial services from Ava Trade Middle East Ltd.

Ava Trade Middle East Ltd is regulated by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) (No.190018).

Avatrade was established in 2006 and expanded to the global markets rapidly. Unfortunately, UAE traders will not find AED currency pairs for trading with this broker and there’s only a live retail account type available. The broker also provides a demo and Islamic (Swap-free) account to its clients. In addition, traders are protected by negative balance protection.

There are more than 1250 assets available for trading with Avatrade, including:

- 64 Forex pairs

- 629 shares as CFDs

- 19 cryptocurrencies as CFDs

- 30 indices

- 17 commodities

Visit broker

8.8

7.63

HFM

HFM is a group of companies operating globally and is regulated in 6 jurisdictions. HF Markets (DIFC) Ltd manages the UAE branch.

HF Markets (DIFC) Ltd is authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885, and the broker has over 10 years of experience.

Unfortunately, HFM doesn’t offer AED currency pairs for trading, but there are more than 3138 assets available for trading with HFM, which include:

- 53 Forex pairs

- 891 shares as CFDs

- 2170 physical shares

- 11 indices

- 13 commodities

The broker offers 4 account types to meet the needs of different traders. Let’s take a look at the comparison table to find out which is best suited to your trading style.

| Premium | Zero Spread | HFcopy | Premium Pro | |

|---|---|---|---|---|

| Spreads on EUR/USD | From 1 pip | From 0 pips | From 1 pip | From 1 pip |

| Commissions | No | Yes. 6 USD round turn per traded lot on Major pairs. 8 USD round turn per traded lot on Minor pairs. | No | No |

| Minimum Deposit | $100 | $200 | €1000 for Strategy Provider, €300 for Follower | $5000 for Professional Client, $500 for ERC |

| Contract Size: | 1 lot = 100 000 currency units | 1 lot = 100 000 currency units | 1 lot = 100 000 currency units | 1 lot = 100 000 currency units |

| Margin Call: | 80% | 80% | 80% | 50% |

| Stop Out Level: | 50% | 50% | 50% | 20% |

| Account currency | USD, EUR | USD, EUR | EUR | USD, EUR, PLN |

| Maximum Total Trade Size (Lots): | 60 Standard lots per position | 60 Standard lots per position | 60 Standard lots per position | 60 Standard lots per position |

| Max Simultaneous Open Orders: | 300 | 500 | 300 | 300 |

HYCM

HYCM is a global Forex and CFD broker registered in 4 jurisdictions. As a group, HYCM is regulated by the DFSA. However, traders opening accounts from the UAE are registering with HYCM Limited.

HYCM Limited is incorporated in St. V & G with incorporation number 25228 BC 2018.

HYCM Capital Markets (DIFC) Limited is regulated by the Dubai Financial Services Authority (DFSA) and holds a category 4 license with a 'Retail' endorsement and is not authorized to hold client assets or client money.

Henyep Markets, also known as HYCM, has more than 40 years of experience in providing financial services to customers globally.

There are no AED currency pairs for trading with HYCM, but they have 301 other assets available for trading, including:

- 71 Forex pairs

- 153 shares as CFDs

- 29 cryptocurrencies as CFDs

- 28 indices

- 20 commodities

The broker offers Fixed, Classic, and Raw account types in order to meet the needs of different traders.

Visit broker

8

7.97

| Fixed account | Classic account | Raw account | |

|---|---|---|---|

| Spreads on EUR/USD | Fixed spreads from 1.5 pips | Variable spreads from 1.2 pips | Raw spreads from 0.1 pips |

| Commissions | No | No | 8 USD per traded lot round turn |

| Minimum deposit | 100 USD | 100 USD | 200 USD |

| Islamic account | Yes | Yes | Yes |

| Min. Trade Volume | 0.01 | 0.01 | 0.01 |

| Negative Balance Protection | Yes | Yes | Yes |

Best Forex broker in the UAE per category

While there are many traders that solely trade Forex pairs, many others prefer trading stock CFDs or cryptos. Therefore, we broke down the list of brokers into different categories and compared the number of instruments offered and trading fees.

Best Broker in the UAE for Forex Trading

| XM | Pepperstone | Avatrade | HFM | HYCM | |

|---|---|---|---|---|---|

| Number of Forex pairs | 57 | 62 | 64 | 53 | 71 |

| Standard account trading fees of EUR/USD | From 1.6 pips | From 1 pip | From 0.9 pips | From 1.2 pips | From 1.2 pips |

Our pick in the Forex category is HYCM, as the broker offers the largest pool of currency pairs to choose from. However, it’s worth mentioning that all 71 currency pairs are only available through the MetaTrader 5 platform.

Best Broker in the UAE for Share CFD Trading

| XM | Pepperstone | Avatrade | HFM | HYCM | |

|---|---|---|---|---|---|

| Number of Stock CFDs | 1261 | 1000+ | 629 | 891 | 153 |

| Commissions | From 0 | From 0.7% | From 0.13% | From 0.01 USD | From 0.6% |

XM offers low trading fees and a large variety of stock CFDs. As such, our pick for this category is XM.

Best Broker in the UAE for Crypto CFD Trading

| XM | Pepperstone | Avatrade | HFM | HYCM | |

|---|---|---|---|---|---|

| Number of Crypto CFDs | 31 | 23 | 19 | N/A | 29 |

| Commissions | From 0.0017 | From 0 | From 0.20% | N/A | From 0.00162 pips |

XM offers the widest choice of crypto derivatives to its clients and trading fees are low; making XM our pick for the top dog in this category.

How to check if the broker is DFSA regulated or is just registered with the DFSA?

Traders from the UAE can open accounts with a DFSA or globally regulated broker. In addition, there are brokers that are not regulated by the DFSA but are registered with the regulatory body. Follow our two-step guide to check if the broker has a DFSA license.

Step 1

Open the Public Register of the Dubai Financial Services Authority.

Step 2

Copy and paste the license number into the search box and press the “Search” button. You will be able to then see the license and all the information pertaining to it.

All DFSA–regulated Forex broker reviews

In addition to the top 5 brokers that we discussed in this review, there are many other brokers to consider that are fully regulated by the Dubai Financial Services Authority. You can find detailed reviews for many of them on our site.